Whole Life Insurance Quotes 101: A Beginner's Guide

Planning to get a life insurance policy for you and your loved ones? Then, here is a comprehensive blog for beginners that covers the fundamentals, steps to do and more.

With a wide range of options in the life insurance market, selecting the best quote that works for you is quite a task.

In this blog, we will highlight the convenience of whole life insurance over other life insurance options while understanding the process of obtaining a whole life insurance quote.

Why is life insurance a must?

It is a contract between the insurance company and a policyholder guaranteeing a certain amount of money upon the policyholder’s death based on the premiums paid during his/her lifetime.

The right life insurance policy ensures that your loved ones are financially secure when you're no longer there to provide.

Here are 3 reasons why life insurance is actually important:

-

Financial help

The best life insurance policy ensures that your family can maintain their standard of living, pay off debts, and cover expenses without significant financial strain after your passing.

-

Settlement of debts

Life insurance can be instrumental in settling outstanding debts, such as mortgages, loans, or credit card balances. This prevents your loved ones from inheriting financial burdens along with their grief.

-

Long-term planning

Life insurance isn't just about meeting immediate needs and can also be used as a tool for long-term financial planning.

Certain types of policies, like whole life insurance, offer cash value accumulation over time, providing a savings component that can be accessed during your lifetime.

What is whole life insurance?

Compared to term life or universal life insurance, whole life insurance is a lot more convenient as it helps in providing guaranteed coverage along with the accumulation of cash value that can help supplement a retirement income.

The policy provides lifelong coverage and the premiums will never increase. This longevity comes with a unique set of benefits, making it a powerful tool for building and preserving wealth.

Whole life insurance combines a death benefit with a savings component known as cash value. The premiums you pay contribute to both aspects, providing a dual-purpose solution that extends beyond traditional life insurance.

Whole life vs term life insurance

To find out the best whole life insurance policy for adults, it is essential to understand the factors that differentiate these two policies. This comparison will also help you better understand why whole life insurance acts as a significant investment opportunity in comparison to term life insurance.

| Whole life insurance | Term life insurance |

|---|---|

| 1) It provides coverage for your entire life while combining a death benefit with a cash value component that grows over time. | 1) This policy covers only a specified term, typically for 10, 20, or 30 years. However, term policies offer death benefits but lack the cash value feature of whole life insurance. |

| 2) They have higher premiums due to the cash value feature and a consistent premium throughout the policyholder’s life. | 2) The initial premiums are lower making it more affordable, especially for younger individuals while providing a higher coverage amount. |

| 3) The coverage lasts throughout the lifetime of the policyholder and could be an ideal option for those seeking long-term protection. | 3) The amount is limited to a specific term and is ideal for people who want coverage for a specific situation or period. |

| 4) This policy accumulates a cash value over time, which policyholders can access or borrow. It provides a form of investment opportunity within the policy. | 4) Term policy is focused on providing the death benefit to the policyholder’s family without any opportunity for investment. |

| 5) Aligns with long-term financial goals for individuals and seems to be an appealing option to those looking for comprehensive financial coverage. | 5) These policies help meet short to medium term financial goals while prioritizing affordability and coverage during specific stages. |

Why does a whole life insurance quote matter?

A quote is an essential instrument for every individual that helps decide the best whole life insurance policy that fits within the policyholder’s budget. Obtaining these quotes would be one of the first steps in getting your insurance policy.

Whole life policy quote helps in providing a breakdown of associated costs, premiums, death benefits, and potential cash values.

Getting quotes from multiple insurance providers empowers you to compare policies from different providers, ensuring you secure the most favorable terms and benefits.

With the help of this comparison, you can identify the policy that offers the best value for your investment, maximizing the benefits for you and your beneficiaries.

4 Factors influencing whole life insurance quotes

Having an understanding of how your quote is being estimated will help you secure the best full life insurance policy that aligns seamlessly with all your financial objectives.

Listed below are some of the basic and important factors that influence your whole life policy quote.

-

Age

As a general rule, the younger you are during the time of purchasing whole life insurance, the lower your premiums will be. Locking in a policy at a younger age not only secures lower costs but also provides a longer period of coverage.

-

Health

Your current health condition significantly influences your whole life insurance estimate. Insurers assess your health through medical examinations and existing medical records. Individuals who are in good health often enjoy more favorable rates.

-

Coverage Amount

The amount of coverage you choose directly impacts your premiums. Thoroughly evaluate your family's financial needs and select a coverage amount that aligns with your long-term goals.

-

Lifestyle

Certain lifestyle choices, such as smoking or engaging in high-risk activities, can increase your premiums. Being transparent about these factors during the quoting process ensures obtaining accurate estimates.

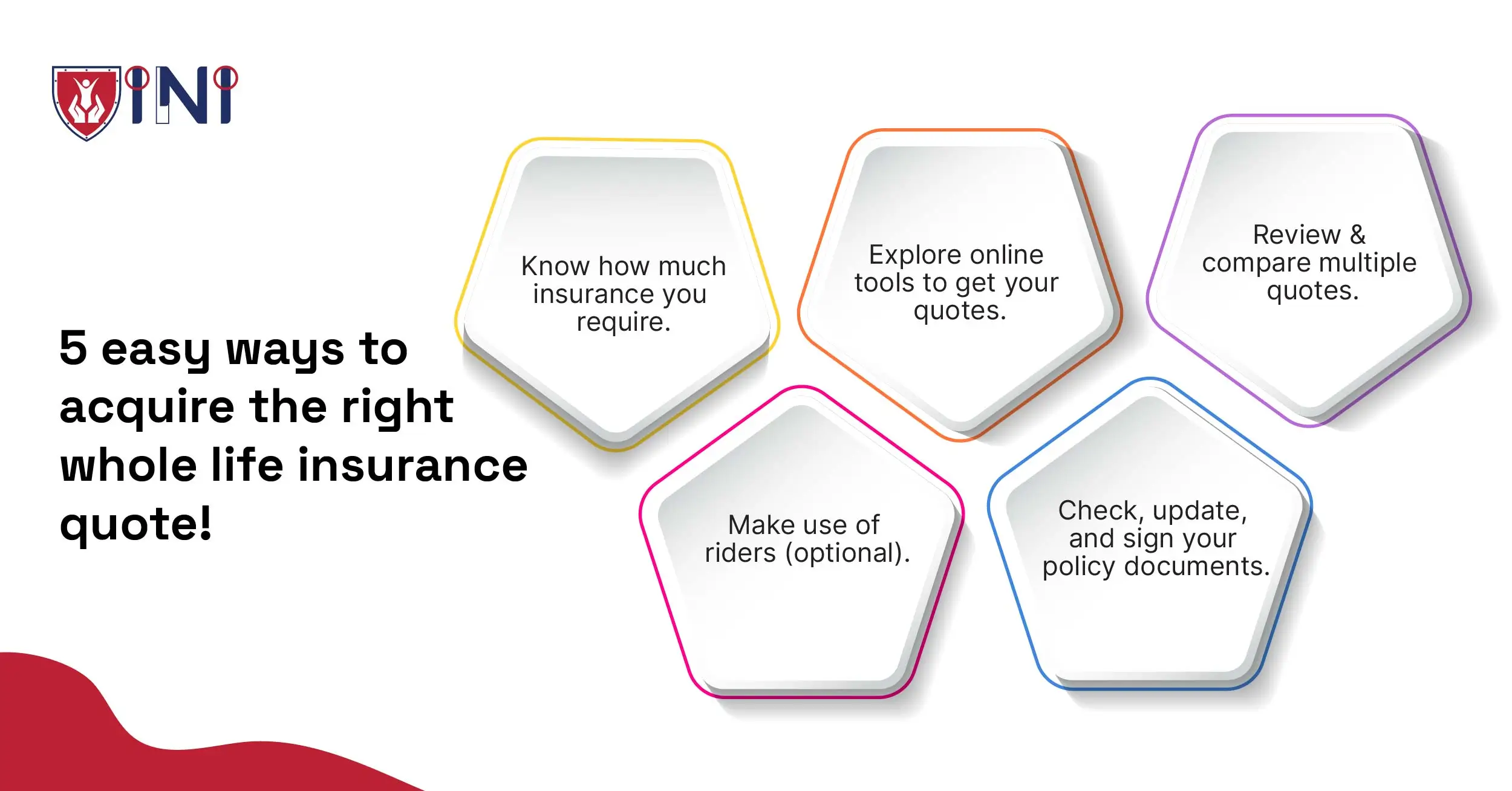

Get yourself insured by following these 5 steps

Whether you’re seeking your first policy or looking for a reassessment and coverage optimization, we have a step-by-step guide to obtain a whole life insurance estimate.

From online tools to the guidance offered by insurance agents, these steps will make sure that you get lifelong protection for your family.

Step 1) Evaluate your insurance amount

Before you start with the research process, understand the total amount you will need. As a thumb rule, the total amount must come up to at least 6 to 10 years of your salary replacing your income until your kids turn 18.

You can also approach this by multiplying your salary by the number of years left until retirement. For example - If you expect to work for 15 years earning $55,000, you would need $825,000 in life insurance.

Step 2) Get your quotes

Start by researching and selecting reputable insurance websites that offer online quote tools. Look for user-friendly interfaces and transparent information.

Once you find one trusted online tool, input your personal information, including your age, gender, health history, and the coverage amount you're considering. The more accurate your input, the more precise your quotes will be.

Step 3) Review and compare the quotes

Based on the entered information, you will receive the quotes. Take your time to review and compare them. Pay attention to the premium amounts, coverage details, and any additional benefits offered by each policy.

During the process of comparison make sure to consider factors such as cash value accumulation, dividends, living benefits, and surrender period.

If you have any questions, don't hesitate to reach out to the insurance providers. Clear communication ensures that you have a comprehensive understanding of the quotes presented.

Step 4) Add riders if needed

Riders are used as an addition to the existing insurance policy allowing policyholders to add specific insurance products to their basic coverage. It is also referred to as an insurance policy provision or scheduling of an item.

Here are some of the common riders that you could add to your whole life insurance policy that might include additional charges:

Disability premium waiver, where the policy stops you from charging the premium if you become disabled.

Accidental death provides a payout to the heirs twice the amount than the listed death benefit if the policyholder passes away in an accident.

Child term rider, helps in providing life insurance coverage to minor children as part of your policy.

Guaranteed insurability, allows the policyholder to increase their death benefit in their senior years while qualifying for the same rate when you apply.

Step 5) Complete your application

Finally, once you’re done reviewing your whole life policy quote, you can go ahead and complete the medical underwriting process. You will have to take certain clinical medical tests to update your health status to the insurance provider.

However, recently, insurers have begun to use accelerated underwriting processes where people with great health are allowed to skip the medical exam, and the health information is obtained from other sources.

Once you’re done with the underwriting process, the insurer will confirm the total coverage amount and the insurance rates you are eligible for.

Once the documents are signed, you will be granted a free look period (10 to 30 days) where you can review your whole insurance quote thoroughly. Within this time frame, the policyholder has the right to cancel the policy without any penalties.

Tips to get the best whole life insurance policy

Not all whole life insurance policies are created equal, and determining the right amount of coverage you need is key to obtaining the best whole life insurance policy for adults. Follow these tips to make sure you get the right life insurance coverage.

Check your family's current and future financial responsibilities. This includes mortgage payments, educational expenses, and any outstanding debts.

Calculate the amount of income your loved ones would need in your absence. This ensures they maintain their standard of living and manage other expenses without any constraints.

On the contrary, over-insuring can lead to unnecessary financial strain. Ensure that your coverage aligns with your financial goals to avoid paying higher premiums than necessary.

Understand and examine the premium structures of various policies. While some policies have level premiums, others may have a modified structure. Choose a premium structure that aligns with your budget and affordability.

It is important to engage with the insurance advisor and get your queries solved. It helps you save a tonne of time and avoids uncertain surprises about your coverage in the future.

Connect with a whole life insurance advisor from Indemnity National Insurance and make the right choices today.

The bottom line

Whole life insurance is one of the most preferred life insurance policies as it has dual benefits and cash value and immediate payout of death benefits.

Factors like your age, health, coverage amount, and lifestyle can highly influence your whole life insurance quotes. Never rush into the process of getting your life insurance as you might end up being overinsured.

We hope this guide gave you a clear picture of how whole insurance policies work. Explore more in our blog section, if you would like to gain a detailed understanding of other life insurance policies and their benefits.

Get your quote & select the right coverage

Did you find this article helpful? Share it!