Choosing the Right Renters Insurance Deductible in Las Vegas

What is a renters insurance deductible?

Renters insurance protects your belongings, covers liability, and aids living expenses during temporary relocations. If you've had health or auto insurance before, you're probably familiar with deductibles.

Deductible for renters insurance also works similarly to the other insurance deductibles. It is the amount you pay out of your pocket to your insurance company when filing a claim. For renters insurance, the deductibles usually apply to damage or theft of your belongings.

Keep reading to know how you can choose the right renters insurance deductible in Las Vegas.

Choosing the right renters insurance deductible

Deductibles will apply to each claim you file. This is because only the covered losses above your deductible are paid by your insurer.

Get your renters insurance quote now within 60 SECS from Indemnity National Insurance and choose the right renters insurance deductible today!

The type of premium amount you choose has an inverse relationship with your deductible. The higher your deductible, the less your insurance company pays towards your covered losses. This will result in lowering your premiums.

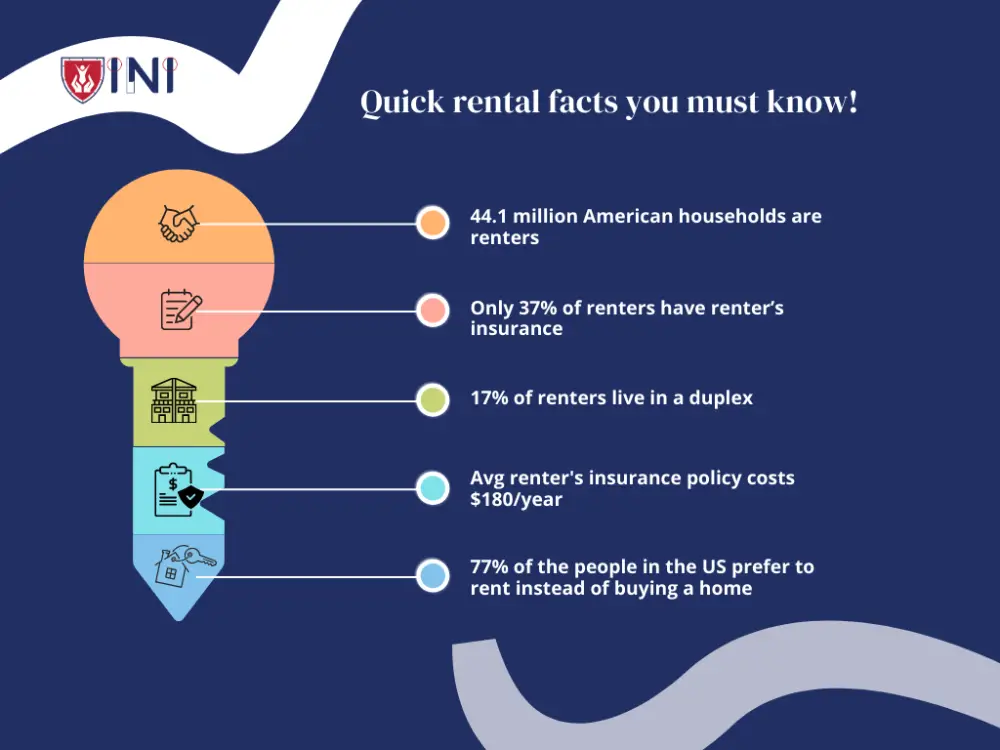

If you raise your deductible from $500 to $1000, your yearly premium decreases by 25%. For instance, if you've been paying $180 annually with a $500 deductible, doubling it to $1000 will lower your premium to $135.

So, if you’re okay with paying higher deductibles and lower premiums on your renters insurance, you can go ahead. But, make sure you have sufficient funds and don’t dilute your savings to pay for deductibles and premiums.

With that, let’s now find out when the deductible applies to your insurance policy claims.

When do renters insurance deductibles apply?

You will have to pay your deductibles usually on the personal property insurance claims as they don’t apply to other renters insurance coverage types.

Are you wondering what’s covered in personal property coverage? The name says it all, your physical belongings such as clothing, furniture, electronics, and more when they’re either lost or damaged by a named peril.

Las Vegas renters insurance includes personal liability, medical payments, and additional living expenses, and there is no need to pay deductibles on these coverage types.

To cut it short, the deductible applies only to personal property insurance claims.

To choose the right renters insurance policy, you can first take inventory of all the items you own within your rental space.

This step can’t be missed because it gives you an idea of what’s the total worth of your belongings along with the clarity of the type of policy to purchase.

Aren’t you curious to understand the factors that affect the price of your renters insurance Las Vegas? We will see what these are, in the next section.

Factors influencing renters insurance Las Vegas

In Las Vegas, having renters insurance is not a legal requirement, but getting one can save you a lot of money in case something happens to your belongings.

According to the Experian data, the average monthly premium for renters insurance is around $15. But, the rates aren’t the same. Based on these factors below, you can expect your to go up or down.

-

Coverage limits

The more items you want to cover, the more you might have to pay. The basic policy of Las Vegas renters insurance is enough to cover all your personal belongings, from electronics to furniture.

But, if you want to further insure high-value items such as fine jewelry, musical instruments, artworks, and ancient collectibles, you might require additional coverage and riders.

We recommend that you start with the basic coverage if you’ve just purchased a rental accommodation in Las Vegas because living in a vibrant locality means more expenses.

-

Location

Insurance is all about handling risks in an efficient manner. So, if you live in a locality where there are higher risks of claims, you will be required to pay more coverage. Here are some of the location-based factors impacting renters insurance rates:

Crime & theft rates in your ZIP code.

Locations more prone to fires, storms, or hurricanes are riskier.

The condition, type, and age of the property you live in.

-

Coverage type

FYI, there are a total of two different types of renters insurance coverage. One is the actual cash value and the other is the replacement cost. You might have probably heard about this if you were researching different types of coverage.

Actual cash value coverage pays the present market value of the item. This means that you will receive the cash value that has been depreciated over the years until now.

Replacement cost pays the total cost of replacing the damaged item with the new one.

Here, if you have a closer look, the actual cash value policies offer cheaper coverage. But, they might not offer the value of the actual item that was damaged.

-

Safety features

You can expect lower insurance rates if your rental property has a lot of safety features installed. This is because the safety features are meant to add an extra layer of protection, reducing the overall risk to the renter as well as the insurers.

Some of the security features include:

Smoke detectors

Deadbolt locks

Sprinkler systems

Video cameras

Gated or secured community

Security alarm systems

These are some of the main factors that affect your renters insurance costs in Las Vegas and possibly other cities in Nevada.

So, if you live in a rental property make sure you are aware of these factors so that once you get quotes from multiple insurance providers, you can compare these factors as a base and find the best deal that fits your budget.

Now that you know the factors affecting your insurance costs, we will now move on to understand how the deductible for renters insurance works in real time .

How does renters insurance deductible work?

In order to avoid excessive claims, renters insurance companies require policyholders to pay a deductible, an amount you pay when filing a claim. This is designed to discourage unnecessary claims, helping insurance companies keep costs lower for everyone.

For instance, if your deductible is $1,000 and you lose something worth $900, it doesn't make sense to file a claim.

The deductible acts as a safeguard, ensuring your insurance covers only the important losses without burdening the company with minor incidents around your rental property.

What if you want to file an insurance claim? What does the process look like? You will see that next!

The renters insurance claims process

Now that you know how renters insurance and deductibles work in Las Vegas, we will move on to understanding the process of applying for the claims.

-

Notifying your insurance company

The first step is alerting your insurance company about the incident. This can be done through a phone call or an online claims portal provided by your insurance provider. Prompt notification is essential to kickstart the assessment process.

-

Submitting documentation

Depending on the nature of the claim, you may need to provide essential documentation. For instance, if you're filing a claim for theft, a police report might be required. Clear and accurate documentation is crucial for a smooth claims process.

-

Collaborating with an adjuster

Working with an insurance adjuster is a critical part of the process. The adjuster assesses the damage, determines the coverage, and ensures a fair amount is provided as part of your coverage.

This collaborative effort helps in understanding the extent of the loss and the compensation you're entitled to.

If the process of your claims sounds overwhelming, you need not worry. Your landlord has a professional property management team to make your claims process more seamless.

Property managers are well-versed in handling insurance claims and can facilitate effective communication between you and the insurance company.

They focus on a quick resolution and help you get back to normal livelihood as soon as possible.

What’s the right deductible for you?

Just like how deductibles play a major role in other insurance policies, they also play an equally important role in your renters insurance Las Vegas.

You can consider determining how much of a deductible is affordable to you along with the unique risks of your location.

In a city that pulses with energy without a big difference between day and night, the decision isn't solely about safeguarding your possessions, it's more about striking a balance that ensures your rental property is safe without imposing a risk on your personal finances.

Secure your rental property now

Did you find this article helpful? Share it!