Survivorship Life Insurance: How It Works & When to Buy

Building a legacy is not an easy task. A legacy that has the potential to last, comes with days of hard work and even years of sacrifice. It is a collective effort by individuals from different generations.

Hence, protecting this legacy becomes imperative. That’s where a survivorship life insurance policy comes into the picture. However, it is not just used for legacy or estate planning.

This blog can serve as a complete guide on second to die insurance policy. We will explore how it works, its benefits, and ways to buy one for your family.

What is survivorship life insurance?

The insurance is also referred to as second to die life insurance and it covers two individuals under a single contract. However, the policy pays out the death benefit upon the death of the second insured individual.

This form of dual life insurance offers a range of benefits compared to traditional life insurance policies. Apart from legacy/estate planning, couples normally opt for survivorship policy to safeguard their savings and assets for their children’s future.

3 key features of survivor insurance policy

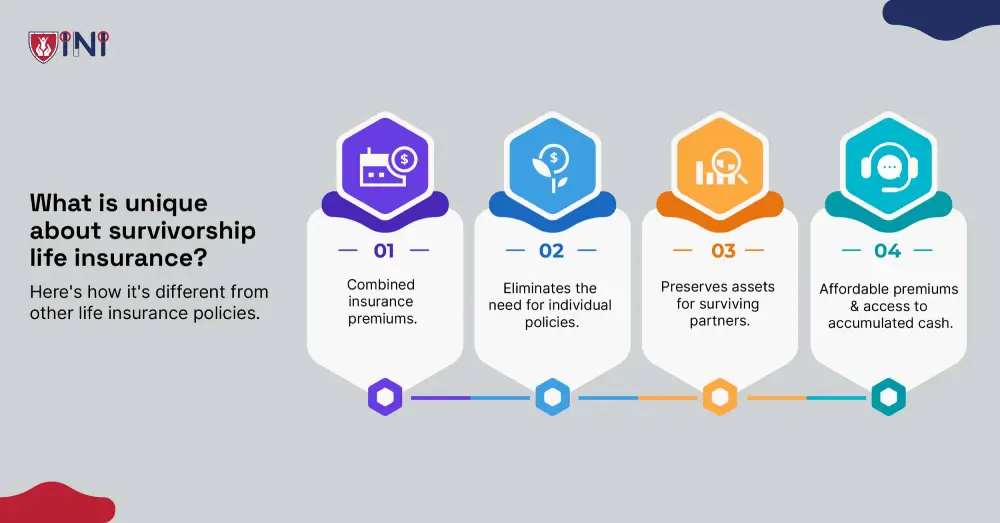

Time to check out why second to die life insurance is different from other life insurance options.

-

Joint policy

-

This type of life insurance policy covers two people like spouses or business partners. There is no need to take separate policies and spend more on premiums.

-

-

Payout death benefit

-

Unlike regular life insurance policies, survivorship policy doesn't pay out after the death of the first insured person. This unique feature allows for the preservation of assets to support the surviving spouse or business partner.

-

-

Lower premiums

-

These policies are cost-effective and often come with lower premiums compared to purchasing two separate individual policies. This affordability makes it an attractive option for those looking to maximize their coverage while minimizing costs.

-

Types of survivorship insurance policies

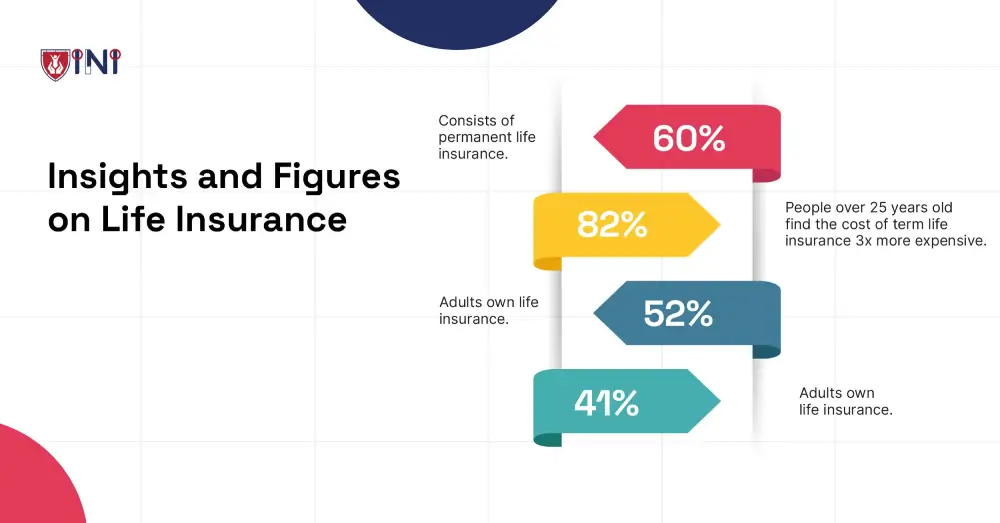

Second-to-die life insurance is permanent life insurance and there are two such types:

-

Whole life insurance

-

This option is attractive for individuals who want the benefits of cash value but not the risks associated with life insurance as they have guaranteed death benefits, premiums, and cash value.

-

If policyholders have the capability to afford it, then this is the best permanent insurance policy.

-

Under this type of insurance, a part of the premium paid goes into the cash value and the balance premium goes into internal policy expenses.

-

This cash value can be accessed by making a withdrawal during times of need, but these withdrawals will reduce the death benefits your beneficiaries receive.

-

There’s something called whole life insurance living benefits, that lets you access money just while you’re living and suffering from long-term chronic or terminal illness.

-

-

Universal life insurance

What sets universal life insurance apart is its flexibility to adjust premium payments. It allows policyholders to tailor their coverage according to their financial situation and future goals.

-

Universal life insurance is considered to be cheaper than whole life insurance as it doesn’t offer few guarantees.

-

Similar to whole life insurance, the policyholder can withdraw funds from the build-up cash value.

-

If you’re someone who can afford to adjust your premium payments, considering universal life insurance could be the right option.

-

Policyholders who want to increase their cash value over a small fixed percentage can go for universal life insurance.

-

How do survivorship insurance policies work?

A survivor insurance policy, often referred to as second-to-die insurance and joint life insurance, pays out the death benefit and a cash value component upon the death of both individuals.

-

The death benefit is a tax-free payout to beneficiaries, issued upon the passing of the second insured party.

-

The primary purpose of survivorship policy is to provide financial protection for loved ones or business partners.

-

Among affluent couples, it is widely used as an estate planning tool to shift the responsibility of managing the tax liabilities to their heirs.

-

The cash value component adds an extra layer of versatility to the survivor insurance policy. As the policy matures, the cash value accumulates, creating a pool of funds that policyholders can access during their lifetime.

-

This financial flexibility enables them to address various needs, including funding education, supplementing retirement income, or handling unforeseen financial challenges.

-

Some death benefits payouts are fixed whereas a few other payout options decrease over time as the policyholder might have tapped into the cash value accumulated.

-

Even upon the passing of the first person, the second insured person must continue to pay the premiums so that the policy is active.

-

Many policyholders confuse second-to-die insurance with the final expense insurance.

-

They think that the death benefits help pay for end of life expenses. But, no! The sole purpose of survivorship insurance is to provide the payout upon the passing of two individuals.

-

To afford all the end of life expenses, individuals need to get a final expense insurance that can provide their family with financial support during times of grief.

-

Don’t know where to start? Consult with experts from Indemnity National Insurance and secure funds for your final expenses.

Who needs a survivorship policy?

This type of unique life insurance policy is often overlooked by individuals thinking, it is only for a wealthy group of people. But that is not the case, even lower-income individuals can opt for a survivor insurance policy.

Let’s find out different profiles that seem to be a good fit for survivorship insurance policies.

-

Couples with estate planning

-

Couples who have a keen focus on estate planning see this as a great opportunity to transfer the responsibility of managing the estate to their heirs.

-

The delayed payout structure, triggered only after the passing of the second insured, aligns seamlessly with the desire to preserve wealth for future generations.

-

By efficiently addressing potential estate taxes, survivorship insurance becomes a base in the legacy-building process, allowing couples to leave behind a financial foundation that withstands for generations to come.

-

-

Business partners

-

To ensure business continuity and growth, partners decide to get a survivor insurance policy to facilitate a smooth transition of business operations in the event of the death of a business partner.

-

This provides enough time for the surviving partner to allocate the resources they need without compromising the enterprise’s stability.

-

-

Families with special needs dependants

-

Dependents who want to receive long-term financial security will highly benefit from a survivor insurance policy.

-

It helps support the ongoing needs of a dependent with special requirements. The delayed payout ensures that the support continues even after both parents have passed away, offering peace of mind and stability for the entire family.

-

-

Individuals looking for cost-effective policies

-

Survivorship policies present a cost-efficient alternative for individuals and couples seeking comprehensive coverage without breaking the bank.

-

By covering two lives under a single policy, these insurance plans often come with lower premiums compared to the combined cost of two individual policies.

-

This affordability factor makes survivorship insurance an attractive option for those mindful of their budget while prioritizing long-term financial security.

-

When to buy a second-to-die insurance policy?

Strategic timing and planning are important for every activity present in the world. When it comes to procuring insurance, it is always better to start early than later. Here are some of our strategic tips to help you choose: when to get a life insurance policy?

-

Start early

-

There’s a mantra that goes like this - “the earlier, the better” which holds true to the entire insurance industry.

-

Opting for a survivorship policy early in life not only secures cost advantages due to lower premiums but also maximizes the potential for cash value accumulation.

-

By initiating coverage when both insured parties are in good health, policyholders can capitalize on favorable rates and establish a solid financial foundation that grows over time.

-

-

Estate planning is on priority

-

Couples who want to secure their estate, and are anticipating uncertainties in their health situation, get second-to-die insurance. p>

-

Families with substantial assets find the delayed payout structure of survivorship policies advantageous.

-

Initiating coverage when estate planning becomes a priority ensures that the financial legacy intended for heirs remains intact, providing a robust shield against potential estate taxes.

-

-

Business transitions

-

Initiating coverage when entering a business partnership ensures protection and provides crucial support in the event of the death of a partner.

-

This foresight becomes a cornerstone for business continuation and shields against potential financial upheavals.

-

-

Budgeting constraints

-

Survivorship policies offer a cost-effective alternative for those mindful of their budget. Couples or individuals with financial constraints may find the joint coverage approach more accessible than individual policies.

-

If the goal is to secure comprehensive coverage while maintaining financial stability, opting for survivorship insurance during periods of budgetary consciousness can be an important decision.

-

Pros and Cons of survivorship life insurance policy

| Pros | Cons |

|---|---|

| 1) One of the primary advantages is its cost efficiency as it covers two lives under a single policy. | 1) The ultimate disadvantage is that it does not provide a death benefit payout after the death of the first insured individual. |

| 2) The premiums are often lower compared to the combined cost of two individual policies. | 2) It could be a drawback for those seeking immediate financial protection for the surviving spouse or beneficiaries. |

| 3) It is beneficial for couples or business partners who are looking for comprehensive coverage at a more affordable price. | 3) They are designed with a focus on long-term goals, such as estate planning and legacy building. |

| 4) Many Survivorship policies come with a cash value component that accumulates over time. | 4) While it offers the potential for cash value growth, accessing this cash value may be subject to certain restrictions and conditions. |

| 5) This feature adds a layer of flexibility and potential wealth accumulation to the policy. | 5) Withdrawal of cash before the payout begins, will result in an overall reduction in the final death benefit. |

Key takeaways

This type of life insurance is more than just a policy as it provides a financial solution for couples and business partners in planning their estate wealth and business stakes.

As with any financial decision, getting guidance from an insurance expert is crucial as they can help individuals and couples evaluate their unique needs, explore available options, and make decisions that seamlessly align with their long-term goals.

We want you to make a sound decision that proves to benefit you and your family in the long run! Visit our blog, to get more insights and knowledge about survivorship policy.

Get a personalized insurance quote now!

Did you find this article helpful? Share it!