Why Second-to-Die life insurance is a smart financial strategy for couples?

If you’re on the search to find ways to protect your legacy that lasts for generations to come, you have landed on the right blog. Second-to-die life insurance might just be the answer you've been looking for.

Surviving couples who are looking to safeguard their family’s financial future find this type of insurance perfect to do their estate planning.

In this blog, we will highlight why second-to-die life insurance is a smart financial strategy for couples and how it can benefit families by protecting the financial legacy

The concept of second-to-die life insurance

Second-to-die life insurance, also referred to as survivorship life insurance, is a policy designed specifically for couples who want to do estate planning.

It is not to be misunderstood with that of a regular life insurance policy as in a second to die life insurance, the benefits can be claimed only after the second surviving spouse dies.

It is not compulsory for the policyholder to have their spouse as a beneficiary. They can have a person who is not a spouse but is closely related to them.

However, this unique insurance plan is mostly purchased by couples who want their cash value to grow and protect their legacy as well as their family's financial future.

How does the second-to-die policy work?

Knowing how second-to-die life insurance works helps couples understand the core elements of how these policies operate. Here are some of the key parts of this type of survivorship life insurance.

-

Affordable premiums and shared coverage

-

One of the attractive aspects of second-to-die life insurance is its cost-effectiveness. In individual life insurance policies, each spouse holds a separate policy and pays out separate premiums each month.

-

Whereas second-to-die policies insure both individuals under one policy and eliminate the need to go through an individual premium payment each month.

-

This shared coverage translates to more affordable premiums. You'll pay a single premium for the joint second to die policy, which is typically lower than the combined cost of two separate policies.

-

This can be a significant advantage, especially for couples who want to protect their family's financial future without straining their budget.

-

-

Payout and death benefit

-

The fundamental principle of a second-to-die policy is that it pays out only after both insured individuals have passed away as the policy is not intended to benefit the spouse upon the passing of the first person.

-

The payouts of second to die life insurance can be beneficial if your goal is to pay estate taxes and expenses that your beneficiaries might face.

-

It can also be highly beneficial for dependent individuals who will require long-term care even after the policyholder’s death.

-

Types of second to die life insurance

There are two types of second to die life insurance. One is whole life insurance and the other type is universal life insurance.

-

Whole life insurance

-

It has a fixed premium accumulating cash value over time. The cash value can be withdrawn and paid out as part of a guaranteed death benefit. In case you fail to repay your borrowings, the death benefit will be reduced.

-

-

Universal life insurance

-

This particular insurance comes with three types of coverage such as variable, indexed, and guaranteed. Policyholders have the autonomy to control how their policy’s cash value is being invested.

-

This type of policy is similar to whole life insurance but has adjustable premiums and death benefits.

-

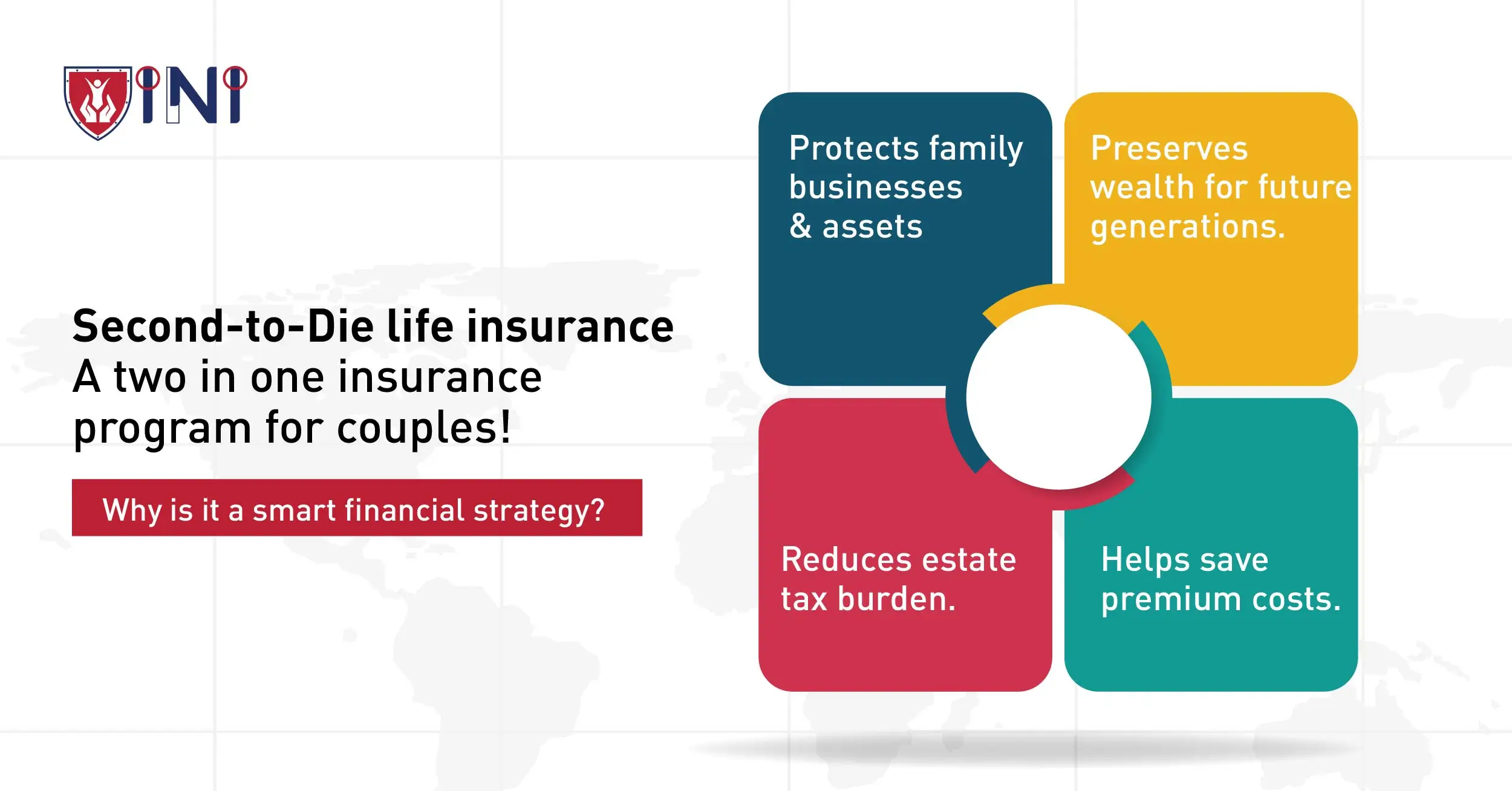

Why is second to die life insurance a smart financial strategy for couples?

Individual life insurance programs are well known and widely used by many individuals as they pay an immediate death benefit to individual beneficiaries upon passing.

But, second-to-die life insurance is another unique insurance option that's particularly beneficial for couples second-to-die life insurance. Let’s understand how to use it the smart way:

-

Estate planning

-

Couples who want to secure their children's financial future and ensure that their assets remain within the family for generations to come can utilize the second-to-die policy to the fullest as it guarantees a financial net for their children.

-

Unlike individual policies that pay out upon the death of a single policyholder, second-to-die policies ensure that the beneficiaries receive a payout only after both partners have passed away.

-

This delayed payout can be invaluable in preserving your wealth for future generations and providing for any dependents.

-

The second to die policy is a strategy that not only protects your legacy but also provides peace of mind in knowing that your loved ones are well cared for.

-

-

Cost savings

-

Combined insurance is always better in terms of cost savings as the premiums for these policies are comparatively lower than paying for two insurance policies.

-

The main reason for their affordability is that the payout offered in second to die life insurance is processed only after the second partner’s death.

-

As a result, the risk to the insurance company is reduced, and this is reflected in the lower premium costs.

-

-

Tax benefits

-

Another compelling reason to consider second-to-die insurance is the potential tax benefits it offers.

-

Estate taxes can be a significant concern for couples with substantial assets, and these taxes can wear off the estate left for heirs.

-

Second-to-die policies can be structured in a way that minimizes the tax burden on your estate.

-

Since the payout occurs only after the passing of both individuals, it can result in a more tax-efficient transfer of your assets to the next generation.

-

By taking advantage of the tax benefits offered by second-to-die insurance, you can ensure that more of your hard-earned assets go to your beneficiaries.

-

-

Legacy protection

-

The second to die life insurance helps guard your family home, business, or other assets to remain intact and within the family's ownership.

-

For couples who have worked hard to build a legacy they wish to pass on, this form of insurance can be a powerful tool to protect their lifetime achievements.

-

Here’s the reason why second to die life insurance is a smart financial strategy for couples. It excels in estate planning, offers cost savings, provides tax benefits, and safeguards your legacy.

By considering a second to die life insurance option, couples can take a proactive step toward securing their family's financial future and ensuring that their hard-earned assets are preserved for future generations.

Get specialized assistance for estate planning. To take your first step towards this wise decision get in touch with INI’s insurance advisors.

Opting for a second to die policy is a forward-thinking financial move that can offer peace of mind and financial security to couples who value their legacy and their loved ones' well-being.

Who can choose a second to die life insurance policy?

This type of insurance is not just for couples but also for closely related partners who can choose their beneficiaries as they wish. Not every couple or partner needs a second-to-die life insurance, but it can be particularly beneficial in the following scenarios:

-

Couples with Children

If you have children who might need your financial support or funds to maintain your legacy, second-to-die life insurance can help disperse these funds accordingly.

-

Blended Families

If you’re part of a family where one or both partners have children from previous relationships, second-to-die insurance can ensure all heirs are treated fairly.

-

High Net Worth Couples

For those with substantial assets, it's crucial to consider how your estate will be taxed upon your passing. A second-to-die policy can help reduce this tax burden.

Second to die policy vs. single life insurance policy

| Second to die policy | Single life insurance policy |

|---|---|

| 1)They are primarily used for estate planning and beneficiaries receive a payout when both partners pass away. | 1)They are typically designed to provide coverage for a single policyholder. The death benefit is paid out when the insured person passes away. |

| 2) It is more cost-effective than individual life insurance policies. Premiums are typically lower because the insurance company assumes lower risk, due to their payout method. |

2) Traditional life insurance is often used to replace lost income and cover immediate financial needs, such as mortgage payments, debts, and daily living expenses. Its purpose is to provide financial support to beneficiaries after the death of the policyholder. |

| 3) By receiving the payout until both policyholders have passed away, the estate can benefit from reduced tax burdens. | 3) Depending on the type of policy (term or whole life), traditional life insurance policy premiums differ. Premiums for whole-life policies are often higher compared to second-to-die policies. |

| 4) The second to die life insurance policy ensures that family assets, or a cherished family home, remain intact and within the family's ownership. | 4) Traditional policies usually offer flexibility, allowing policyholders to choose the coverage amount and duration that suits their preferences. |

To conclude

Financial planning differs from one individual to another, second-to-die life insurance can be a smart strategy for couples looking to protect their legacy and provide financial protection for their loved ones.

Before finalizing your decisions we recommend you compare other available options and understand how they fit into your financial goals

This further assists you to make an informed decision that paves the way for a secure financial future for your family.

Start your estate planning! Request a quote

Did you find this article helpful? Share it!