Your Budget-Friendly Health Insurance Options in Florida

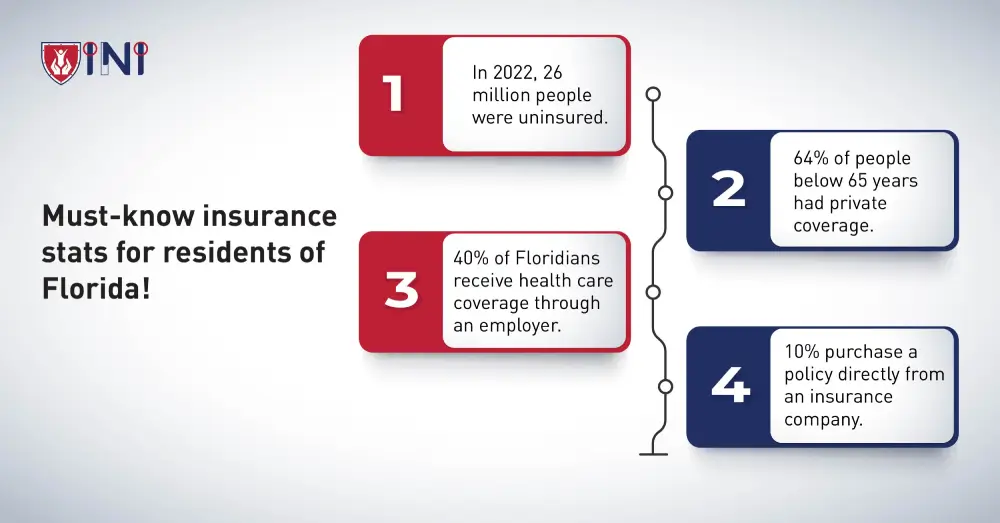

Florida Health Insurance primarily helps you cope with unexpected medical expenses, get timely access to medical services, and afford prescription medications.

But, with different plans available in Florida, finding one affordable plan is quite a task.

Today, we will help you overcome this challenge by offering valuable tips on how to apply for budget-friendly health insurance options in Florida, with a specific focus on Obamacare insurance Florida.

Understanding Obamacare insurance Florida

The Affordable Care Act (ACA), commonly known as Obamacare, was introduced by then-President Barack Obama in March 2010 to make healthcare more accessible to millions of uninsured Americans who had low-paying jobs and were unemployed.

-

The law offered expanded coverage options apart from Medicaid eligibility by creating health insurance exchanges. More than 16 million Americans benefited from Obamacare within the first 5 years of introduction.

-

In Florida, all the ACA plans are mandated to cover 10 essential benefits that include emergency services, prescription drugs, and maternity care.

Are you wondering how you can apply for Obamacare Florida plans?

-

Floridians can enroll in Obamacare insurance during the annual open enrollment period from November 1 to December 15.

-

The Federal Government has extended the enrollment window to January 16, 2024.

-

Coverage for those enrolling during this period starts on February 1, 2024.

-

Missing open enrollment requires waiting for a special enrollment period.

-

Qualifying life events, like moving, having a child, getting married, or losing health coverage, are necessary for a special enrollment period.

Obamacare insurance Florida eligibility criteria

To be eligible to enroll in Obamacare Florida plans, you:

-

Must live in the United States

-

Must be a citizen of the U.S. or be lawfully present as a national

-

Cannot be confined in jail or prison.

Under the Affordable Care Act (ACA), individuals who are insured through the Health Insurance Marketplace benefit from special patient protections.

Here's a breakdown of the key provisions:

-

Your insurers will not be able to refuse the coverage based on any pre-existing conditions or your gender.

-

There can’t be any lifetime or any annual limits on coverage for all the essential health benefits.

-

Young adults get an extension until age 26 to stay on their family’s insurance plan.

Now that you know the main eligibility criteria, let us next move on to understanding the process of enrollment.

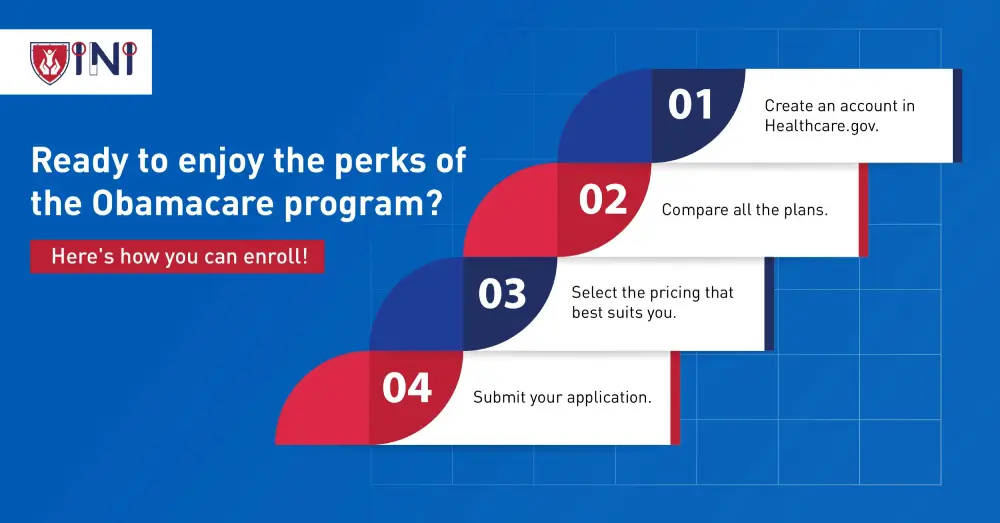

How to enroll in Obamacare Health Insurance?

-

Once you’re all ready to get Obamacare Florida plans, you need to create an account on HealthCare.gov or through Florida’s When you’re platform.

-

After creating an account, you will compare and select the plan and pricing that best suits your medical needs.

-

The enrollment process is pretty straightforward and you can ask your insurance provider for any questions before getting started.

In the next section, we have highlighted some of the important things you will need to ensure a successful application.

Things you need before applying

When you’re applying for health insurance, it will be convenient if you have all the information handy, right?

So, here we have provided with you a breakdown of specific pieces of information and documents that you may need to provide to ensure a smooth and accurate application process.

-

Social security numbers of all the beneficiaries on your application.

-

Your income and employer information of everyone in your household.

-

Current health insurance policy numbers. (If you have any ongoing policy)

-

Information on health insurance provided by your employer.

-

Immigration documentation if you’re an immigrant.

If you need more information regarding all the prerequisites to apply for Obamacare insurance, get a quick quote from Indemnity National Insurance and choose the best coverage that suits your financial and medical needs.

Despite offering so many benefits, Obamacare has been a controversial topic since it was first introduced. So, let’s assess the pros and cons to understand the implications of this healthcare reform.

Pros and Cons of Obamacare insurance Florida

The Affordable Care Act has been an attractive option for lower-income individuals. But, like any other policy in the market, Affordable Care Act Insurance Florida also comes with pros and cons

Pros:

-

Increased access to health insurance

The Affordable Care Act expanded Medicaid eligibility and established Health Insurance Marketplaces, providing a platform for Floridians to access affordable health insurance plans.

-

Coverage for pre-existing conditions

Obamacare prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions, ensuring that individuals with health issues can still obtain insurance.

-

Essential health benefits

Obamacare mandates coverage for essential health benefits, including preventive services, maternity care, and mental health services, promoting comprehensive healthcare for individuals and families.

-

Preventive services at no extra cost

Many preventive services, such as vaccinations and screenings, are covered without additional costs, encouraging early detection and proactive healthcare measures.

-

Coverage for young adults

The ACA allows young adults to stay on their parent's insurance plans until the age of 26, providing continuity in coverage during a transitional period in their lives.

Cons:

-

Premium costs

The premiums for certain plans under Obamacare can be relatively high, particularly for individuals who do not qualify for subsidies and those who have already held health insurance.

-

Limited choice of providers

Some insurance plans under Obamacare may have a restricted network of healthcare providers, limiting choices for individuals seeking specific doctors or specialists.

-

Complexity and administrative challenges

The intricate nature of the ACA and its regulations can lead to administrative challenges for both individuals and businesses, causing confusion and potential compliance issues.

-

Fines can be imposed

The main goal of Obamacare is to insure all the individuals throughout the year. If you’re uninsured and don’t have proper proof of exemption, you will be required to pay a fine amount.

While Obamacare has significantly increased the number of insured individuals in Florida and addressed insurance issues in the healthcare system, the disadvantages cannot be left out.

As policymakers continue to evaluate and refine the insurance and healthcare industry, we are sure there will be changes to this healthcare reform as the economy continues to grow.

Would you like to grab some of the best tips offered by our insurance experts? Stay tuned for it as we are about to share them with you below.

Tips to select the right health insurance plans

Finding health insurance plans in Florida can be complex, but with strategic guidance, the process becomes more manageable and most importantly affordable.

Here are a few practical tips that you can implement immediately to find budget-friendly health insurance options:

-

Understand your health needs

Begin by assessing your health needs. Consider factors like pre-existing conditions, prescription medications, and expected medical expenses. This understanding will guide you in selecting a plan that aligns with your specific requirements.

-

Evaluate coverage options

Thoroughly review the coverage options available under your choice of health insurance plan

Different plans may vary in terms of services covered, deductibles, and copayments. Look for plan options that address your anticipated healthcare needs with a balance of affordability.

-

Check network providers

Examine the network of healthcare providers associated with each insurance plan. Ensure that your preferred doctors, specialists, and hospitals are within the plan's network to avoid unexpected out-of-network costs.

-

Consider total costs

Don’t just look into the monthly premium amount. Evaluate the total costs, including deductibles, copayments, and coinsurance. A plan with a higher premium may have lower out-of-pocket costs, and vice versa. Choose a balance that suits your budget.

-

Utilize online tools and resources

Take advantage of online tools provided by insurance companies and the Health Insurance Marketplace. These tools often include calculators, plan comparison features, and educational resources to streamline your decision-making process.

-

Check prescription drug coverage

If you have regular prescription medications, ensure that the plan provides adequate coverage. Review the formulary to understand which medications are covered and at what cost.

-

Review plan ratings

Research plan ratings and read reviews from current policyholders. This can offer insights into the satisfaction levels of individuals who have experienced the plan's coverage and services firsthand.

You can take a screenshot of these tips and use them later, but believe us, following these tips can help you get access to affordable health insurance policies out there in the market.

Next up in our blog is the comparison between Obamacare vs private insurance in Florida. Let’s accept the fact that if Obamacare doesn’t work we need to explore other options too.

Without any delay, let’s compare!

Spotlight on differences: Obamacare vs private insurance

If you are an individual earning a decent income, you might be open to exploring private insurance plans apart from Obamacare Florida plans.

So, let’s break down all the key differences between Obamacare vs private insurance to help you decide what works well for you.

| Obamacare | Private insurance |

|---|---|

| 1. Obamacare provides options for individuals who may not have access to employer-sponsored plans or those with pre-existing conditions. | 1. Private insurance plans often provide more customization options and individuals can tailor coverage to specific needs, selecting plans that align with their preferences and budget. |

| 2. The Health Insurance Marketplace created by Obamacare offers a variety of plans, often with subsidies to make coverage more affordable. | 2. You will get a broader network of healthcare providers, as you get to choose from a wider range of doctors, specialists, and hospitals. |

| 3. It prevents denial of coverage based on pre-existing conditions.

Individuals with health issues can obtain coverage without facing discriminatory practices. |

3. There will be shorter wait times for certain medical services and this can be advantageous for individuals seeking immediate access to specific treatments or procedures. |

| 4. Obamacare mandates coverage for essential health benefits, ensuring that certain services like maternity care and mental health services are included in all plans. | 4. These plans can have more variable costs, and individuals may face higher premiums based on factors like age and health status. |

In short, choosing one insurance plan depends on your individual circumstances and we recommend you assess your healthcare needs, budget, and preferences to determine which option aligns best with your unique requirements.

If you’re still not able to decide, worry not! There are several budget-friendly health insurance options available for individuals and families. Keep reading to find out more about them.

Budget-Friendly health insurance options in Florida

Securing affordable and comprehensive health insurance is a priority for many Floridians, but finding one budget-friendly plan is a complex task. Here are a few alternative options to consider:

-

Health Insurance Marketplace

You can explore the Health Insurance Marketplace at Healthcare.gov to find affordable health insurance plans. Depending on your income, you may qualify for subsidies that can lower the cost of your monthly premiums.

-

Medicaid

If you have a low income, you may be eligible for Medicaid, which provides free or low-cost health coverage to eligible individuals and families. Florida has specific eligibility requirements for Medicaid, so it's important to check if you qualify.

-

Children's Health Insurance Program (CHIP)

CHIP provides low-cost health coverage to children in families that earn too much money to qualify for Medicaid but cannot afford private insurance. If you have children, this could be a good option to explore.

-

Short-Term Health Insurance

Short-term health insurance plans are designed to provide temporary coverage for individuals in transition. While they may not offer the same level of coverage as traditional plans, they can be more affordable.

-

Catastrophic Health Insurance

Lastly, if you're under 30 or qualify for a hardship exemption, you may be eligible for a catastrophic health plan through the Marketplace. These plans typically have lower monthly premiums but higher deductibles.

Please keep in mind that these options are available in the market for you to provide just the basic coverage.

You need to review and check your policy thoroughly so that all your medical needs and expenses are covered, as this is the primary purpose of obtaining health insurance.

What are the next steps?

Don’t miss the deadline! The last day to enroll in the Obamacare program is January 16th, 2024. Get your documents ready and apply so that you don’t miss the benefits offered by Obamacare insurance Florida.

You can either apply it online or through your nearest insurance provider. We advise you to not wait until the last day. Research your options, sit with your insurance provider, and understand what coverage works well for you.

Your goal is to secure budget-friendly health insurance, so focus on that and prioritize the financial well-being of you and your family.

The right policy is just a click away.

Did you find this article helpful? Share it!