Medicare Plan N vs. Plan G: What You Need to Know

With the rise in the aging population, there are great healthcare opportunities that can be used by seniors who are aged 65 and older. Medicare is a federal program that helps seniors by offering a variety of coverage options, giving seniors access to affordable and quality healthcare encouraging them to live longer.

“Old age is like everything else. To make a success of it, you’ve got to start young.”- Theodore Roosevelt

In this blog, we will understand 4 main differences between Medicare Advantage vs. Supplement, and its benefits, and compare Medicare plan N vs. plan G to give you an idea about its features and costs. Let’s begin our journey.

What is Medicare Advantage vs. supplement?

Medicare Advantage

Medicare Advantage plans also known as Part C, are being offered by private insurance companies that are approved by Medicare.

In 2023, a lot of people are exploring the Medicare Advantage plan due to the additional benefits offered.

-

These plans combine the coverage of Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) and often include extra services like vision, dental, and prescription drug coverage.

-

However, these plans have certain provider networks, that require you to use in-network doctors and facilities.

-

The beneficiaries are allowed to use healthcare providers, doctors, and hospitals that are within the plan’s designated network.

-

In rare case scenarios for emergency care, outside the network is covered whereas routine care necessitates visiting in-network facilities.

-

This is considered for individuals who have established relationships with specific doctors and medical centers.

Medicare Supplement

Medicare Supplement also known as Medigap plans provides unique features that address any gaps in coverage by enhancing the overall experience for beneficiaries. They are supplementary insurance policies that are designed to work alongside Medicare Part A and Part B.

-

The main purpose of this plan is to cover gaps that are involved in original Medicare coverage.

-

These gaps comprise copayments, coinsurance, and deductibles that beneficiaries would otherwise need to pay out of their pocket.

-

One main advantage of Medigap plans is their standardization. They are labeled with letters A to N, each representing its own set of benefits.

-

This system of labeling helps simplify the process of comparing different Medigap plans from various insurance providers.

4 ways to choose Between Medicare Advantage and Medicare Supplements

The decision to choose between both these options is a real battle and highly depends on an individual’s circumstances, preferences, and healthcare needs.

Here are 5 simple ways that can help you choose the right one:

-

Primarily Medicare Advantage plans offer convenience by offering bundled coverage and additional benefits into a single plan, often with lower premiums.

-

On the other hand, Medigap plans usually provide great flexibility when it comes to personally selecting healthcare providers and facilities but comes with higher premiums.

-

During your consideration and research phase, it is advisable to individually evaluate your healthcare requirements, budgets, and preferences.

-

To get personalized guidance, we recommend you consult with an insurance agent or a Medicare counselor to make informed decisions to align with your unique needs and preferences.

Medicare Plan N vs. Plan G

These two plans come in with a lot of similarities but there are certain differences that we have listed below in brief for quicker understanding!

| Plan N | Plan G |

|---|---|

| This plan is an attractive option for those who are looking to balance between coverage and affordability. | This plan is often appreciated for its comprehensive coverage. It mostly covers all the gaps from the original Medicare. |

| It helps cover various costs that include Part A coinsurance, skilled nursing facility coinsurance, and Part B coinsurance. | It includes both Part A and Part B deductibles, coinsurance, and excess charges. |

| This plan typically doesn’t cover Part B deductible or excess charges. | The only drawback people often notice in this plan is that it doesn’t cover the costs of Part B deductible. |

| This plan stands out from the rest due to its unique feature, i.e. cost-sharing arrangement. | People opting for this plan end up leading a peaceful routine as it covers most of the medical expenses. |

| Here the beneficiaries are required to initiate a copayment for certain doctor office visits and emergency room visits. | It also offers the most flexible option, i.e. the flexibility to choose from any available doctors and hospitals that accept Medicare patients without restricting the members to a particular network. |

| This requires some out-of-pocket expenses, as it contributes to lower monthly premiums when compared to comprehensive plans like Plan G. | There are also usually no co-pays with Plan G. If you happen to visit your doctor frequently then this plan is best suitable for you. |

Cost Consideration

Costs involved in deciding between Medicare Supplement Plan N and Plan G play a significant role.

-

The premium that is required to be paid by individuals who choose Plan N is lower when compared to individuals who choose Plan G due to its cost-sharing arrangement.

-

Some of these Plan N coverages require you to pay copayments for some healthcare services and these costs can still be lower than the higher premiums of Plan G.

-

Individuals who prefer to opt for Plan G coverage pay higher premiums but receive robust benefits ultimately leading to lower out-of-pocket expenses.

-

Depending on your healthcare needs the higher premiums can be balanced and eliminate copayments and deductibles.

Enrollment and Eligibility

To be eligible for this plan generally requires individuals to be at least 65 years and older and they need to be enrolled in Medicare Part B. The enrollment periods differ and it consists of an initial enrollment period around your 65th birthday, special enrollment periods for specific circumstances, and the annual enrollment period during which you get to make certain changes to your coverage.

Medicare benefits that both Plan G and Plan N cover - according to Medicare.gov

-

Part A coinsurance and hospital stays up to an additional year after Medicare benefits are claimed and used.

-

Part A deductible.

-

Part A hospice care coinsurance/copayment.

-

Coinsurance for skilled nursing facility care

-

Coverage for blood transfusion (first three pints).

-

Medically necessary emergency healthcare services during the first 60 days when traveling outside the U.S. (including Deductible and limitations).

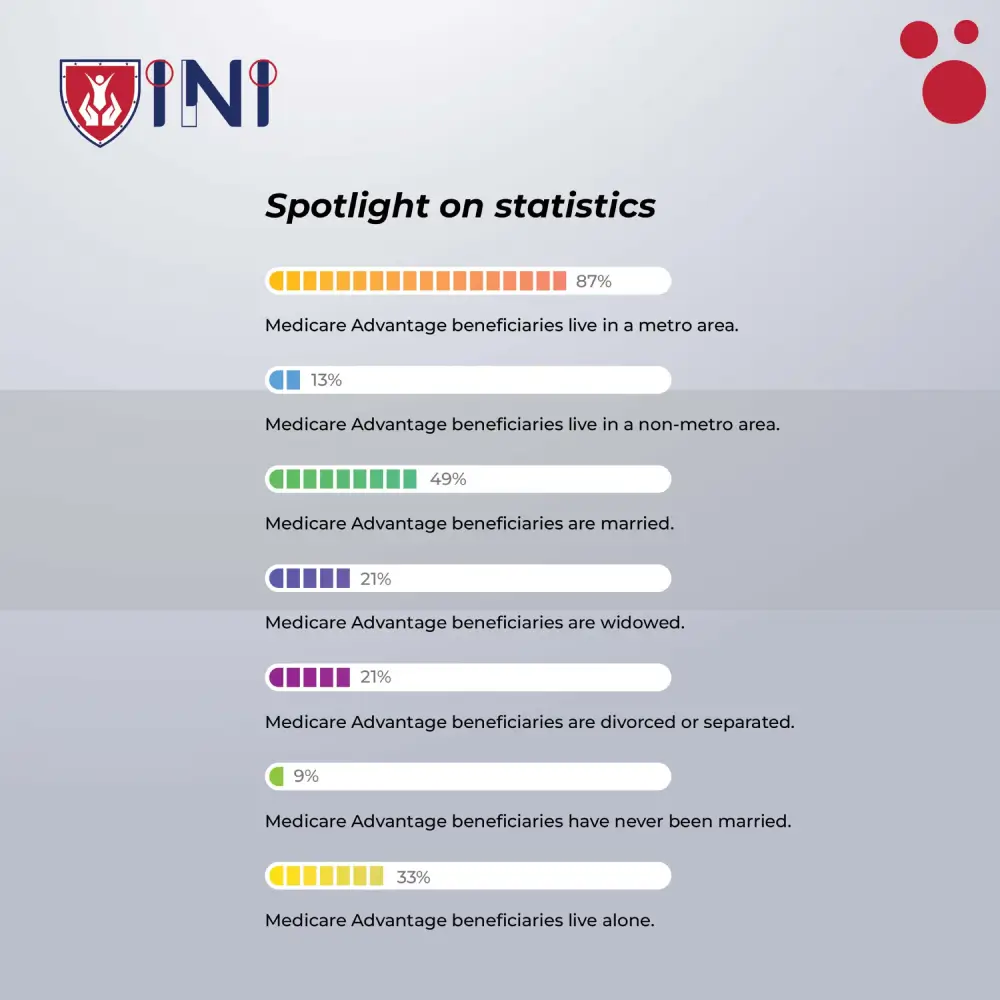

Spotlight on statistics -

-

87% of Medicare Advantage beneficiaries live in a metro area.

-

13% of Medicare Advantage beneficiaries live in a non-metro area.

-

49% of Medicare Advantage beneficiaries are married.

-

21% of Medicare Advantage beneficiaries are widowed.

-

21% of Medicare Advantage beneficiaries are divorced or separated.

-

9% of Medicare Advantage beneficiaries have never been married.

-

Over 33% of Medicare Advantage beneficiaries live alone.

5 features of Plan N Medicare supplement

Due to its lower premiums, the Plan N Medicare supplement is gaining popularity and we will discuss it in detail.

-

Plan N works together with Original Medicare to help you pay less for your health care. When you receive a Medicare-approved service, Medicare pays its share of the approved amount, and then Plan N pays its share.

-

You only pay your share, which may include a small copayment or deductible. Plan N also covers you when you travel outside the U.S., up to 80% of the emergency care costs.

-

Plan N is a standardized plan, which means that it offers the same benefits regardless of the insurance company you choose. However, each company may charge different premiums and have different customer service and ratings.

-

Therefore, it is important to shop around and compare different Plan N options before you enroll.

-

This plan is a great option for people who want comprehensive coverage at a lower cost than Medigap plans.

How much does this plan N cost?

The cost of this Plan varies depending on various factors such as your age, gender, location, health status, and the insurance company you select. According to Healthline, the average monthly premium for Plan N in 2020 was $111. Your rates might differ based on your location and financial situation.

The Pros and Cons

Plan N

The Medicare supplement Plan N offers the advantage of paying lower monthly premiums while still covering certain medical expenses. The cost-sharing structure of Plan N might be appealing, particularly for those individuals who visit healthcare providers not so frequently.

However, the copayments and potential Part B excess charges could accumulate for those requiring more medical attention.

Plan G

Due to its comprehensive coverage feature, Plan G provides peace of mind and helps predict costs. Even if the monthly premium is higher when compared to Plan N, there are no expected out-of-pocket costs. This is mostly suitable for individuals with major healthcare needs.

How to make the right decision?

To choose an option that works best for you, begin by evaluating your current health status and anticipated medical needs. If you feel like you’re a healthy person and don’t anticipate the need to visit healthcare providers frequently, Plan N could be the right choice for you.

On the other hand, if you’re concerned about your health and your ability to meet higher medical expenses in the future, Plan G’s comprehensive coverage might benefit you in the long run.

We advise you to conduct research and compare the costs, and coverage details of all the plans. Utilize all the resources around you, online and offline such as the official medicare website, insurance advisors, and family/friends who already have experience in this process.

To wrap this up,

Medicare options and coverages are vast and differ from one plan to another in terms of benefits offered and premium amounts paid. There is no one perfect solution for each individual in particular. Your decisions should be made based on your healthcare needs and the budget that you can possibly allocate for future medical expenses. With a thorough understanding of the available options and terms, you can make a perfect decision to live peacefully during your golden years.

Choose the plan that is right for you!

Did you find this article helpful? Share it!