The Pros and Cons of Switching Medicare Plans During Open Enrollment

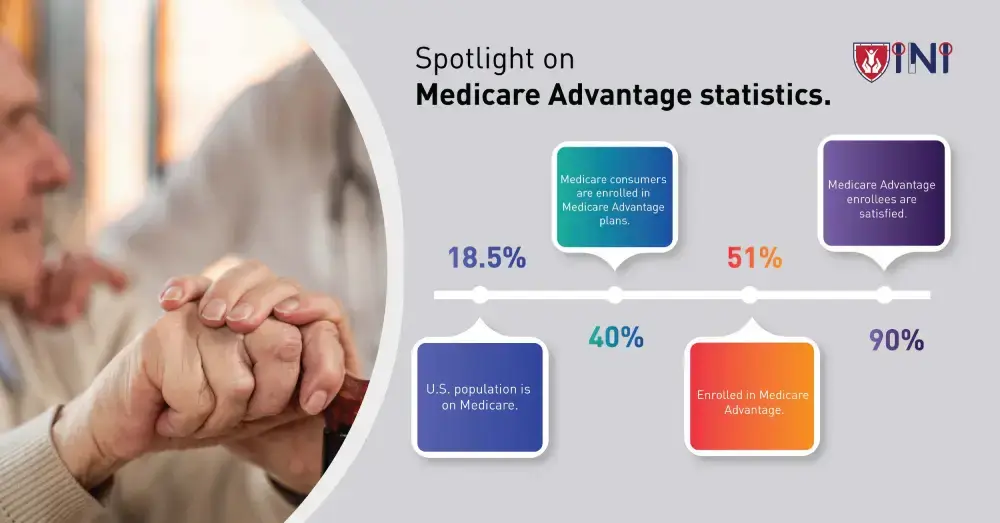

Gear up my Medicare buddies, the Medicare Advantage enrollment period is beginning in 2 months. It is going to be that time of the year when you get a chance to make significant changes to your medicare advantage plan.

In this blog, we will learn about the Pros and Cons of switching Medicare plans during open enrollment and look at some of the best ways to choose 2023 Medicare Advantage plans.

What is the Medicare Advantage enrollment period?

This period is specifically dedicated to Medicare Advantage enrollees who wish to change from one Advantage plan to another or switch to traditional Medicare.

If you would like to do so, you can do it between January 1, 2024 to March 31, 2024. This enrollment period is distinct from Medicare open enrollment which happens from October 15, 2023, to December 7, 2023.

In addition to that, if you have Medicare Advantage or Part D plan of Medicare with a 5-star quality rating available in your area, you will be able to switch to a 5-star plan between December 8th 2023, and November 30th of the following year using the 5-star special enrollment period.

Pros of switching Medicare plans

-

Access to new benefits

-

When you consider switching Medicare plans, you open doors to receiving multiple benefits.

-

Every year, insurance providers introduce fresh benefits to attract enrollees.

-

Some of the 2023 Medicare Advantage plans introduced innovative offers such as telehealth services and expanded mental health coverage.

-

-

Save on healthcare costs

-

This is one of the most compelling reasons available for enrollees to consider switching their plans. Premiums, copayments, and deductibles vary from plan to plan.

-

During the open enrollment period, you can choose the plan according to your ability to afford these costs.

-

This helps you align with your healthcare budget and may reduce your overall healthcare expenses.

-

-

Network and healthcare provider flexibility

-

When switching plans, be careful with the network of healthcare providers you choose. Some Medicare Advantage plans have an extensive network while others are more inclusive.

-

By changing your plans, you either extend or limit your network of doctors, specialists, and hospitals as per your choice.

-

This flexibility helps you to continue seeing your preferred doctors and healthcare professionals.

-

Cons of switching Medicare plans

-

Losing current benefits

-

Switching between plans during the enrollment period might result in losing your current plan benefits.

-

If you’re content with your current plan, think about switching it as you might lose existing benefits even if you get access to additional ones.

-

You need to take time and compare the benefits received from the current plan with those of the prospective ones to avoid any unpleasant surprises.

-

-

Intrusion of care

-

Changes in Medicare plans can sometimes intrude on the existing care you are receiving.

-

This is especially true for those individuals who have an ongoing treatment plan or have an established relationship with healthcare providers.

-

Switching plans require individuals to make adjustments. You might have to coordinate with your healthcare team and research provider networks in order to mitigate these intrusions.

-

-

Pre-existing medical conditions

-

If you rely on one network or healthcare provider who provides specific medications due to pre-existing conditions, altering your plan requires careful consideration.

-

Make sure that your plan covers essential medications and services by healthcare professionals in order to avoid gaps in your Medicare coverage.

-

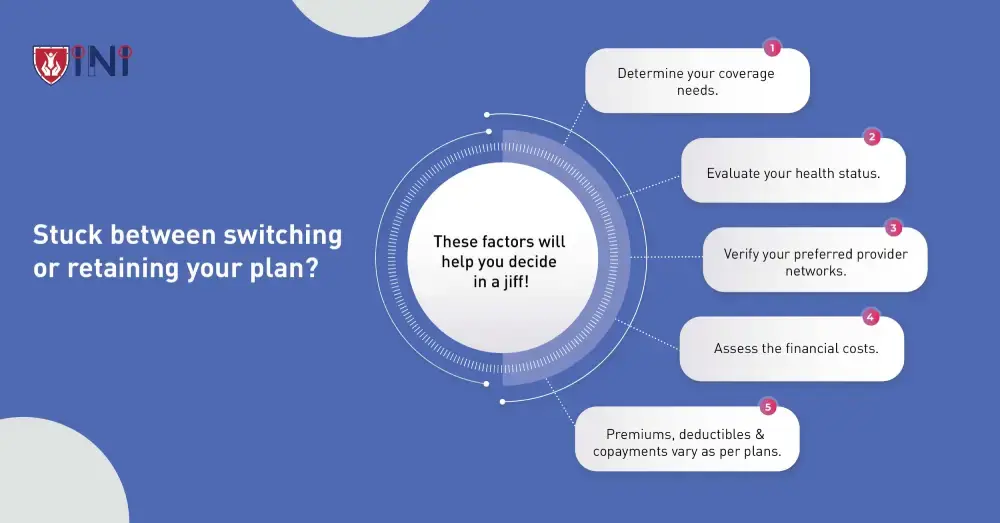

Factors to consider while switching Medicare Advantage plans

Switching your Medicare plans is a significant decision that has an impact on your financial and physical well-being.

To make the best choices, consider the following factors when assessing your options during the enrollment period.

-

Coverage needs

-

Understanding what you need in your coverage, is one of the most important factors in the decision-making process.

-

Evaluating your health status, anticipated medical expenses, and specific healthcare requirements will help you guide your choices.

-

For example- if you have regular dental checkups or require vision care, choose and prioritize those plans that offer comprehensive dental and vision coverage.

-

By aligning your plan with specific needs, you can ensure that you receive the necessary healthcare services and treatments essential for your well-being.

-

-

Provider networks

-

Before going ahead with the plan changes, it is important for you to verify if your preferred healthcare provider networks are part of your new plan.

-

The regular doctors, specialists, and healthcare facilities that you visit must be a part of the plan’s network to ensure the continuity of care.

-

This is because there’s nothing more frustrating than switching to a new plan and discovering that your trusted healthcare provider is not accessible anymore.

-

There is a smarter way to avoid such inconveniences. You can contact your current network of providers and inquire about the Medicare Advantage plans that they accept.

-

Additionally, you can use online tools to search for doctors, specialists, and facilities within your plan’s network.

-

-

Cost evaluation

-

Assessing the financial aspects of a plan is as important as checking if you have enough coverage. Various costs such as premiums, deductibles, and copayments, can significantly impact your healthcare budget.

-

Some Medicare Advantage plans may have affordable premiums while others might be expensive. This depends upon the plan you choose and the coverage you expect.

-

These copayments and deductibles are associated with each plan and they vary according to the plan size. Mostly they’re paid as out-of-pocket expenses.

-

A plan with lower deductibles will help you save money over the course of the year and affect the amount you pay for doctor's visits, hospital stays, and other services.

-

If you have ongoing medication needs consider your plan’s prescription drug coverage. Every plan has its own formulary and list of drugs covered. Make sure your medications are a part of the formulary.

-

We recommend you have a balance of all these factors in order to find a plan that best fits your healthcare needs and financial circumstances.

How to use the Medicare Advantage enrollment period?

Many individuals often confuse the Medicare open enrollment period with the Medicare Advantage enrollment period. Both are different and occur in a different time window.

The time allotted for Medicare Advantage enrollment starts from January 1st 2024, and goes on until March 31st 2024. This is a crucial time if you want to improve the quality of healthcare you receive.

Here we will focus on how to make the most of the Medicare Advantage enrollment period:

-

Enrolling and switching plans

-

If you’re new to Medicare, you can sign up for a new Medicare Advantage plan during this period or if you’re enrolled in a plan, you can either switch to a new plan or go back to your original Medicare.

-

If you’re a part of a prescription drug coverage, you can remove it or add one if you don’t have it already.

-

-

Researching 2023 Medicare Advantage plans

-

The first step to using the Medicare Advantage enrollment period is to effectively research available 2023 Medicare Advantage plans.

-

There will be changes in Medicare Advantage plans each year from benefits they receive to costs and provider networks.

-

You can start with the medicare plan finder to explore available plans by entering your zip code and personal healthcare needs to get a list of plans available in your area.

-

Browse the individual plans one by one to access detailed information to compare monthly premiums, copayments, deductibles, and provider networks.

-

-

Assessing your healthcare needs

-

Checking your health status during the medicare advantage enrollment period is essential as it helps you align the plan with your health.

-

Check if you have any ongoing medical conditions that require specialized care in the future.

-

Understand if you require prescription drugs, or any additional benefits such as dental, vision, hearing, or wellness programs. Make sure your new plan offers all these essential services.

-

-

Consulting an approved Medicare specialist

-

It is possible to get a Medicare Advantage enrollment by yourself, but certain elderly individuals find it challenging to do all the research by themselves and end up making wrong choices that can lead to complications in the future.

-

Consulting with Medicare specialists ensures that you receive personalized guidance to explore 2024 Medicare Advantage plans.

-

-

Taking timely actions

-

Once you’re done with your research and decision-making process, the next step is to be proactive and act promptly as the Medicare Advantage enrollment period has a strict timeline.

-

If you miss it, you will have to wait until the next enrollment period to make necessary changes to your coverage. So, don’t take too much time to research the plans and anticipate health issues.

-

Start your research process before the official enrollment period starts. This will save you an ample amount of time during the enrollment process.

-

At Indemnity National Insurance, we aim to lower your out-of-pocket costs by selecting the best affordable plan for you. Check us out for a quick consultation.

Key takeaways

2023 Medicare Advantage plans offer innovative healthcare benefits to all those who have enrolled.

However, the upcoming medicare advantage enrollment period will bring in additional updates and changes.

Individuals who want to improve their healthcare should start their research right now in order to make the right and confident choices during this critical time frame and if you require information resources, visit our blog right away.

Modify your Medicare plan instantly.

Did you find this article helpful? Share it!