Life Insurance Vs Health Insurance: What's the difference?

The new year 2024 has already begun and the resolution buzz is all over the internet. And guess what's often at the top of the list? Yep, you guessed it right – Goals to stay healthy.

In today’s blog, we will help you ease the process of your financial planning by listing out the key differences between life insurance vs health insurance while sharing some insights about short term health insurance in Texas.

Let’s make 2024 the best year for all your healthcare needs!

Why life insurance?

Is health and life insurance the same? No, they’re not. Let’s understand it in parts.

The basic use of life insurance is that it helps secure your family by paying out a lump sum when you pass away. The death benefit must cover all expenses and obligations that you may leave behind.

Here are 4 top reasons why you should get life insurance:

-

If you’re the breadwinner of your family, a life insurance policy acts as a reliable source of income for your family.

-

It helps manage day-to-day expenses and ensures that major financial goals like education and homeownership can still be achieved.

-

Debts can be settled without diluting your family’s savings. Based on the coverage you choose, life insurance can help your beneficiaries pay off outstanding bills and mortgages.

-

More than immediate financial needs, life insurance also makes it easier for your beneficiaries to plan the inheritance and manage the estate taxes without the need to sell all the assets.

Investing in life insurance isn't about predicting every uncertainty, it's about mitigating the risks and safeguarding what’s left so that your family can lead their life without having to worry about monthly budget constraints.

Once you’ve made up your mind to get yourself a life insurance coverage, you will have to select one type that best fits your family’s needs.

In the coming section, let’s see what each type has to offer before unwrapping the differences between life insurance vs medical insurance.

4 types of life insurance

The decision to get life insurance can’t be made without weighing the options available in the market. Different types of insurance serve varied purposes and selecting the right one involves careful analysis of the drawbacks and benefits of each type of life insurance.

Have a closer look at the types below

-

Term life insurance

-

It is a low-cost policy meant to provide you with coverage on a term basis. The purpose of getting term life insurance is to replace your income upon your passing.

-

The contract between you and the insurance company will be set up for a predefined period of 10 to 30 years based on your needs.

-

During the term, you will be making premium payments each month and if you pass away during the term, the company will pay your beneficiaries the death benefit.

-

The good thing is the death benefit is income tax-free and once the term expires, your life insurance protection also comes to an end unless you decide to get another policy by renewing or switching to a new life insurance policy.

-

There is no cash value component in term life insurance as it is specifically designed to give your beneficiaries a payout in case you pass away during the term.

-

As the cash value is not present in term life insurance, you can get more coverage which means a higher death benefit. If you are looking for the cheapest life insurance, term life can be your best fit.

Get your term life insurance from Indemnity National Insurance in 3 easy steps.

-

-

Whole life insurance

-

If you’re looking to get insurance that lasts an entire lifetime unlike term life insurance, you can go for whole life insurance.

-

It is a permanent life insurance policy, offering coverage to policyholders for the entire duration of their life as long as their premiums are paid on time.

-

Once you take a whole life insurance policy, you don’t need to worry about any policy renewals as long as you commit yourself to paying the premiums on time.

-

There won’t be any fluctuations in the premium amount and you can withdraw funds from your policy or take a loan.

-

Wondering how? Well, the more sincere you are towards paying the premiums, a part of it gets accumulated into a cash value account.

-

However, your death benefit will be reduced as you withdraw money from the cash value account.

-

If you’re not comfortable with paying a higher and constant premium amount throughout the life of your loan, you can explore universal life insurance options.

-

-

Universal life insurance

-

This also works like your whole life insurance but has a slight difference. Universal life insurance offers flexibility in paying premiums.

-

In addition to that, you can also adjust your death benefit while withdrawing money against the policy’s cash value.

-

If you’re someone who wants to build savings that are deferred from taxes, and you don’t have any plans to use your funds for a long time, universal life insurance can be your best choice.

-

-

Final expense life insurance

-

Did you know that funeral expenses can cost up to $10,000? Yes, and they are increasing rapidly. But at the same time, getting final expense life insurance is the cheapest among all the insurance types available.

-

It can help your family members to manage your end-of-life arrangements without any financial or budget constraints. In addition to that, it also helps pay outstanding medical bills up to a certain amount.

-

We say this is one of the easiest to get because there is no strict medical examination involved here. This feature in particular helps seniors with pre-existing health conditions.

Well there you have it, these are the major types of life insurance. But did you notice, that most of the life insurance options out there provide coverage only for the beneficiaries?

What if you want to get any medical treatments done, how do you cover the costs? Here’s where health insurance comes into the picture. Let’s see why you would also need health insurance before diving into the key differences between life insurance vs health insurance.

-

Health insurance - How it works?

Getting sick and recovering from an illness is not easy, both mentally and financially. Minor to major injuries, can cost more than thousands of dollars to diagnose. So, how can you cover all these expenses without health insurance?

With health insurance in place, you can spend on the treatment of your critical illness without any worries about incurring higher medical costs. It also provides you with tax benefits under section 80D.

But, the question you might have is – How do I get a health insurance policy?

You can get it through 👇

Your job if your employer is offering one.

Your parent’s plan if you’re age is below 26.

An insurance company.

Your college or university if they have a student plan.

The Federal health insurance marketplace.

Health insurance consists of premiums, deductibles, copayments, coinsurance, and healthcare provider networks.

Ultimately, health insurance ensures that your medical expenses are manageable without the need for you to tap into the savings.

Now, it’s time to discuss the main differences between life insurance vs health insurance so that you can decide what to get first and if you really need both these policies to maintain a balanced lifestyle.

Life insurance vs health insurance - Ultimate Comparison

Health insurance and life insurance serve different purposes and cover two different things entirely. While both are essential, we will understand how are they different from each other so that you can choose the best coverage for you and your family.

| Life insurance | Health Insurance |

|---|---|

| 1) They provide a death benefit upon your passing and protect your family from financial strain. | 1) They cover all your medical expenses right from treatment costs to prescription drugs. |

| 2) Coverage offered is based on what you choose. It changes based on your choice of term life, whole life insurance or universal life insurance. | 2) The coverage is typically provided on an annual basis and you can renew the policy if your healthcare needs change. |

| 3) Acts as a safety net, offering financial support to cover immediate expenses, outstanding debts, and income replacement for beneficiaries. | 3) Shields policyholders from the financial burden of medical treatments, preventive care, and unexpected health crises. |

| 4) The main difference between life insurance vs health insurance is the former is focused on covering the passing of an individual. | 4) It includes a range of services, including hospital stays, prescription medications, and surgical procedures, aiming to ensure policyholders have access to necessary healthcare resources. |

| 5) They can be more expensive, particularly for comprehensive coverage, making it essential to align with long-term financial goals. | 5) Offers varying plans to cater to different budgets, with options for individuals, families, and employer-sponsored plans. |

Before getting any insurance policy, you need to understand how well it serves you and your family members. What level of coverage do you require? Are you open to switching between policies? Do you require cash value accumulation? Don’t overlook these tiny details and make sure you choose a coverage that is both affordable and comprehensive.

If you don’t want to commit yourself to one particular health insurance plan, there are short-term policies that you can try out. More details are below!

Short term health insurance in Texas

If you are going to choose short term health insurance Texas, you can choose a coverage ranging from 1 to 12 months. If you don’t have health insurance currently, short term health insurance Texas can help you.

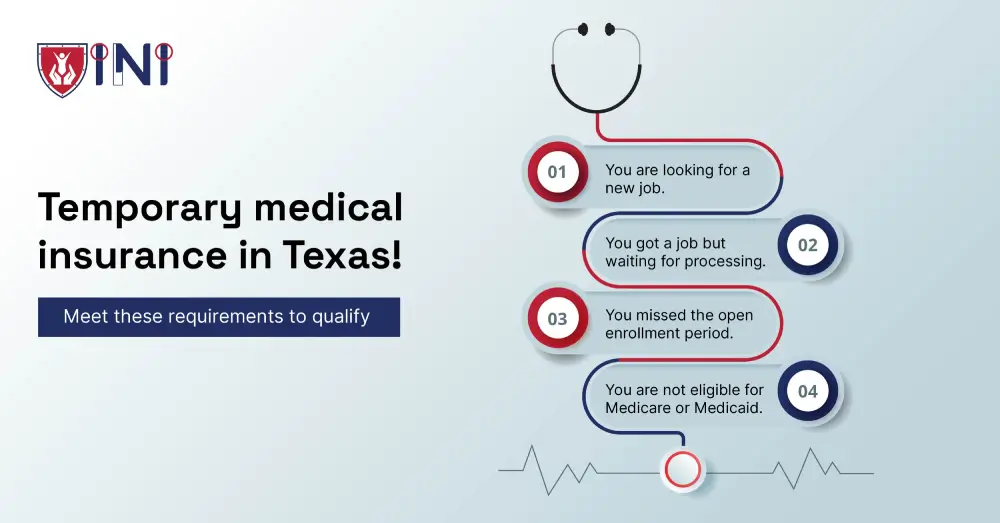

It provides coverage for a limited amount of time until you get new health insurance. You can get a short term medical insurance Texas for yourself if you are:

-

Searching for a new job.

-

Self-employed & looking to purchase a new plan.

-

Missed to get coverage during the open enrollment period.

-

Starting a new job but waiting for the processing.

-

Not eligible to get Medicare or Medicaid.

You can cancel the short term health insurance Texas anytime you want and your coverage will close the last day you make the premium payment. If you’re reading this and you fit into the above situations, go ahead and get yourself temporary medical insurance Texas.

What should you get first?

If you’re a newbie and you don’t have any insurance policies going on, we recommend you get health insurance first because life can throw some uncertain health consequences.

To successfully come out of it, completely cured, a health insurance plan is a must. Shop around and select the right coverage that is both comprehensive and financially affordable to you.

Life insurance is needed, but you get to choose! People of all ages can get it, but be wise in the type of life insurance you choose. If you’re committed to paying on-time premiums, whole life or universal life insurance will be the best option to go for.

Check out our blogs from Indemnity National Insurance, if you want to learn more about the term life vs whole life insurance. Also, if you’re not insured currently, don’t forget to explore Texas short term health insurance plans.

Explore affordable insurance options at INI.

Did you find this article helpful? Share it!