Fireproofing Your Finances: Insights into Wildfires and Home Insurance in California

California's picturesque landscapes and mild climate have long attracted homeowners seeking to settle in the Golden State. However, in recent years, the threat of wildfires has intensified, putting both homes and finances at risk. As the frequency and severity of wildfires increase, it becomes crucial for California homeowners to take proactive measures to protect their homes and ensure adequate insurance coverage. In this blog post, we will explore the rising threat of wildfires in California and provide valuable insights on securing affordable and comprehensive home insurance to safeguard your property and finances.

Understanding the importance of home insurance

With climate change exacerbating fire conditions, California has experienced a surge in wildfires, putting homes at greater risk. It is crucial to stay informed about wildfire-prone areas and assess the potential dangers specific to your location. By understanding the growing risk, you can take proactive measures to protect your property.

Home insurance acts as a safety net when disaster strikes. It provides financial protection against fire-related damages, ensuring that homeowners can rebuild and recover. However, finding affordable home insurance in California can be a challenge, especially in high-risk areas.

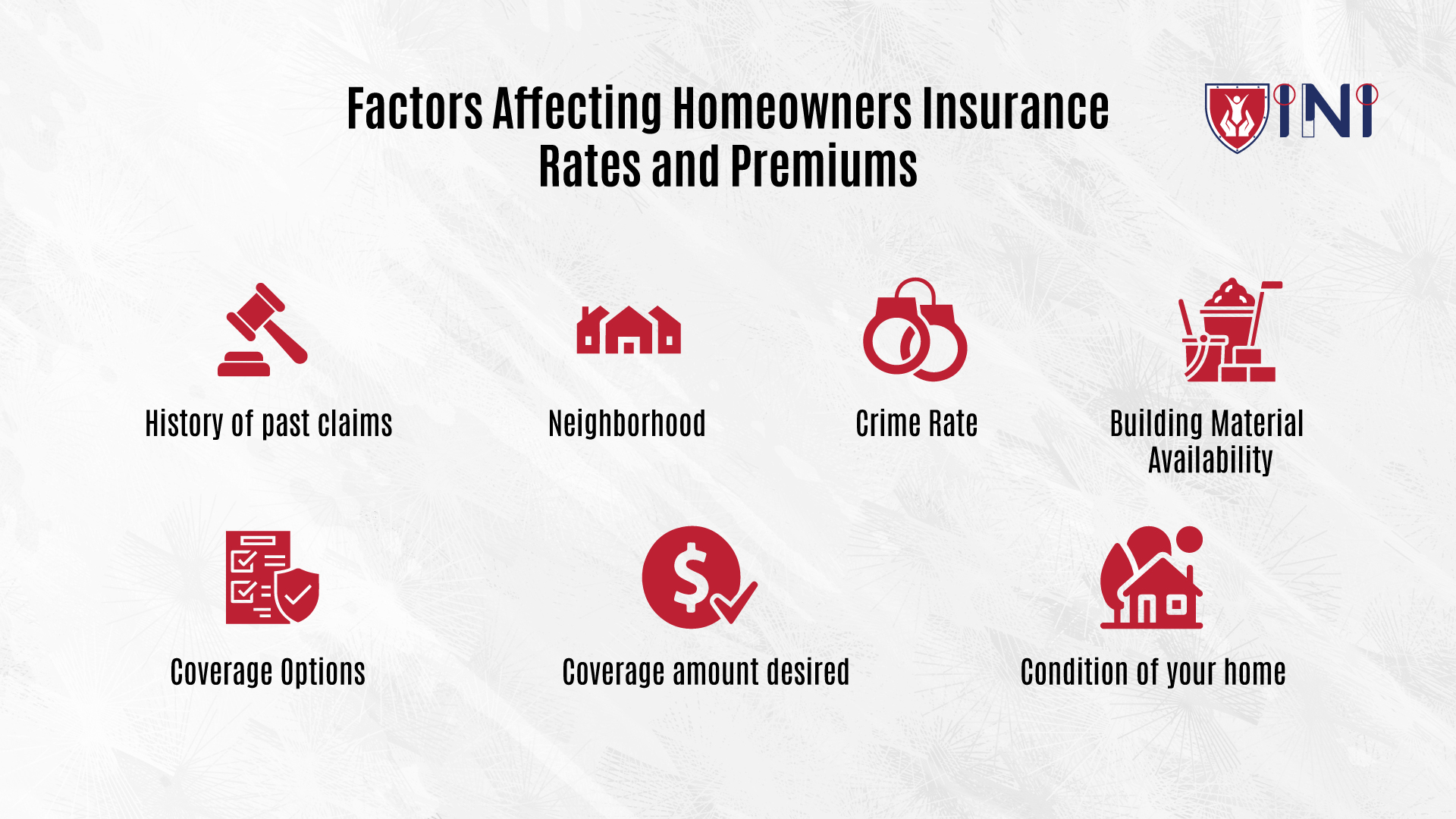

It is important to explore your options and compare quotes to secure the best coverage at an affordable price.

Exploring Cheap Home Insurance in California

While cost is a significant factor, it is essential not to compromise on coverage when seeking cheap home insurance in California. Look for insurers who specialize in wildfire-prone areas and offer policies tailored to meet the unique needs of homeowners facing this specific risk. By researching and comparing different insurance providers, you can find cost-effective options without sacrificing protection.

When evaluating home insurance policies, pay close attention to the coverage provided for wildfire-related losses. Ensure that your policy includes protection for both property damage and personal belongings. Additionally, consider additional living expenses coverage, which can help cover the cost of temporary housing if your home becomes uninhabitable due to a wildfire.

Government Assistance and Regulations

Alongside securing insurance coverage, implementing measures to mitigate wildfire risks is crucial. Clearing vegetation around your property, maintaining a defensible space, and installing fire-resistant materials can significantly reduce the vulnerability of your home. Consult with local fire departments and experts for guidance on effective fire-smart strategies.

In response to the escalating wildfire threat, the government has implemented various assistance programs and regulations to support homeowners. Stay informed about available resources such as grants, loans, and tax incentives for wildfire mitigation efforts. Familiarize yourself with local building codes and regulations that enforce fire-resistant construction standards for new homes or renovations.

Strengthening Financial Resilience

Navigating the complex world of home insurance can be overwhelming. Consider seeking professional guidance from insurance brokers or agents who specialize in wildfire-prone areas. They can provide expert advice, help you understand policy terms, and assist in finding the best insurance options to suit your needs and budget.

In addition to securing home insurance, it is prudent to bolster your financial resilience against the aftermath of a wildfire. Build an emergency fund to cover unforeseen expenses, maintain an up-to-date inventory of your belongings, and store important documents in a safe place. These measures can help streamline the claims process and ensure a smoother recovery.

To Summarize…

In conclusion, as the threat of wildfires continues to escalate in California, it is imperative that homeowners take proactive steps to protect their homes and finances. Understanding the wildfire crisis, assessing the significance of home insurance, and securing affordable coverage are fundamental in safeguarding against potential losses.

By adopting comprehensive coverage options, implementing preventive measures, and staying informed about government initiatives, homeowners can increase their resilience in the face of this growing threat. Remember, being proactive today can make all the difference tomorrow when it comes to protecting what matters most – your home and loved ones.

Did you find this article helpful? Share it!