Group Universal Life Insurance - Definition, Types, Pros & Cons

Before applying for one, you can’t afford to miss the opportunity to understand the ins and outs of group universal life insurance because it’s highly affordable. Why miss the chance?

Come, let’s have a detailed discussion about the affordable insurance policy - Group Universal Life Insurance.

What is group universal life insurance?

They are offered to a group of people at a cost lower than usual life insurance policies and are commonly purchased by companies that want to provide their employees with life insurance coverage.

Keep reading to know why GULI is the optimal choice for saving money

3 features of group universal life insurance (GULI)

The group universal life policy is a form of permanent life insurance that is not just budget-friendly but also provides savings opportunities to the policyholders.

Here there’s no need to get a separate insurance policy and it may even be free for certain employees.

Here’s why we think GULI stands out from other policies:

-

Term life insurance

-

GUL insurance introduces a level of adaptability that traditional life insurance plans may lack. With GULI, you have the liberty to adjust your premium payments and death benefits according to your life circumstances and family situation.

-

If you’re looking for a life insurance plan that is both flexible and customizable, GULI is the best one to go for.

-

This ensures that your plan aligns seamlessly with your evolving needs, providing a responsive approach to financial protection.

-

-

Cash value accumulation

-

An exceptional aspect that is favorable to many policyholders of GULI is its cash value accumulation feature.

-

A portion of the premiums you pay contributes to a dedicated cash account, which steadily grows over time.

-

This accumulated cash value serves as a valuable asset, presenting you with various options. Need a loan? Want to make a withdrawal? Or maybe you're thinking about having a bit extra for your golden years – GULI's got you covered.

-

-

Investment Options

-

With GULI, you can start investing! Unlike other insurance plans, a group universal life policy allows you to invest the cash value component in a variety of investment spots, offering opportunities for growth.

-

This feature not only protects your family but also helps you build up wealth as you pay your premiums. Sounds cool isn’t it?

-

But, what type of group life insurance works well for you? Keep reading to know!

Types of group life insurance

GUL insurance is one of the types. However, apart from GULI, there are two other types of group life insurance that you need to be aware of.

They are group term insurance and variable universal life insurance. We will discuss this in detail here:

-

Group term insurance

Key feature

Nature of coverage

Coverage focus

This is the most common and budget-friendly type of group life insurance as the premiums are paid up to a certain period specified as a term.

Policyholders need not go through an underwriting process to get it. It operates on a yearly renewal basis, providing coverage for a specific term (typically one year).

Group term insurance primarily offers a death benefit. In the unfortunate event of the insured person's death during the coverage period, a lump sum payment is made to the designated beneficiaries.

Cost consideration

-

Variable group life insurance

Key feature

Nature of coverage

Investment component

Similar to group universal life policy but with an investment twist. >VUL insurance offers investment opportunities through sub-cash accounts that operate similarly to mutual funds.

The variable component may lead to market fluctuations that can be a benefit if there are high returns but it can also lead to losses if the market conditions are unfavorable.

Variable GUL offers the same flexibility as GUL but if your cash value balance is too low, you might have to pay higher premiums to keep your variable group life insurance active.

Policyholders can allocate the cash value into different investment spots, potentially increasing returns. However, it also comes with associated risks, as the value of the investments can fluctuate, and you can even lose money.

Cost consideration

It is the least expensive option among group life insurance types, making it an economical choice for employers offering life insurance benefits to their employees.

Variable group life insurance tends to be costlier than both group term and traditional GULI due to the added investment feature.

Now you know why getting a group universal life insurance involves a strategic approach and mindset.

While group term insurance is a straightforward and cost-effective option, group universal life and variable group universal life provide a more comprehensive approach.

You might have noticed that they not only offer a death benefit but also incorporate a cash value element while introducing you to investment opportunities for potential growth but the additional costs and risks can’t be overlooked.

The choice between these types depends on individual financial goals, risk tolerance, and the desire for added flexibility and benefits beyond a basic death benefit.

Don’t worry, you need not rush to select one type already! We are here to equip you with additional information so that you can choose the ideal insurance plan while getting maximum protection.

Come let’s weigh the benefits and drawbacks so that you can make a wise decision.

Pros and cons of group universal life insurance

When it comes to financial matters, the decision you make should be based on your needs, situation, and level of risk tolerance.

To do that, assessing the pros and cons is a must! If you want to strike a balance between both affordability and comprehensive protection, get ready to explore the pros & cons of GULI below. /p>

Pros:

-

Flexibility max

GULI allows policyholders to adjust their premium payments and death benefits, providing a flexible approach that adapts to changing life circumstances

-

Accumulated cash value

One of the standout features is the ability to build cash value over time. This cash value can be utilized for loans, withdrawals, or as a supplementary source of retirement income.

-

Opportunities to invest

Unlike traditional life insurance, GULI offers investment options for the cash value component, potentially allowing for additional growth and financial flexibility.

Cons:

-

Higher cost

GULI typically comes with a higher premium compared to basic term life insurance due to the added features, such as the cash value component.

-

Complexity

The flexibility and investment options in GULI may introduce complexity. Understanding the intricacies of the policy requires careful consideration, and some individuals may find it more challenging to navigate.

-

Comes with market risks

If you’re opting for variable group universal life, the investment component introduces market risks. The value of investments can fluctuate, impacting the overall performance of the policy.

Are you still thinking if GULI isn’t the one for you? Don’t fret! Let’s also learn how term life insurance plans can benefit you, by comparing term life insurance vs universal life insurance.

Term life insurance vs universal life insurance - Explained

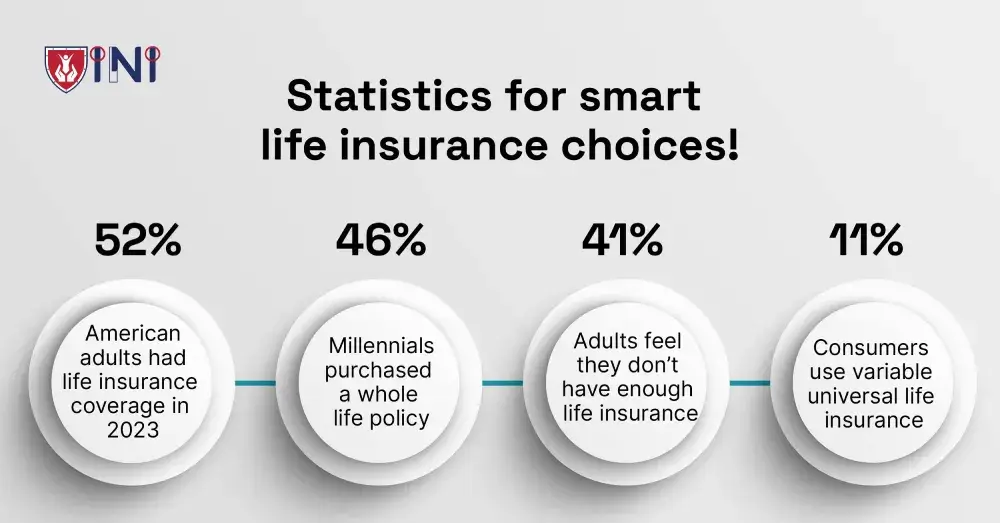

We know that choosing the right insurance plan is quite a task. Individuals in the United States commonly find themselves at the crossroads between two primary options: term life insurance and universal life insurance.

It is not just about getting an insurance plan. It’s more about how well a plan benefits you and your family during uncertain times.

Want to know the differences between term life insurance vs universal life insurance? Let’s go.

Term life insurance

-

They are 100% straightforward! Let’s say you’re renting a home. There’s a set period until which you decide to stay on rent, right? Term life insurance works pretty much the same way.

-

They are usually fixed for a term period of 10, 20 or 30 years as per the policyholder’s decision. This means that if you pass away within this term, your death benefits can be used by your beneficiaries.

-

If you happen to live beyond the term, the benefits expire and you might have to get a new policy or renew it

-

Term life insurance is often more affordable than other types, making it an excellent choice for those seeking basic coverage without breaking the bank.

-

It is as simple as that! To know more about the premium amounts and the suitable terms for you, get an instant quote from Indemnity National Insurance.

Alright, let’s see how universal life policy is distinct from term life insurance👇

-

This is permanent coverage. It’s more like owning a home rather than renting one. You get a combination of death benefits, flexible premium payments, and a cash value component.

-

The cash value built up using universal life insurance can be used for loans, withdrawals, or even as an investment for potential growth.

-

Due to its flexibility, the universal life insurance plan is a bit more expensive than term life insurance.

Whether you prefer the simplicity of term life insurance or the flexibility of universal, both options offer valuable protection. It’s your choice!

Ready to apply?

Before you choose a GULI plan, consider your current financial situation, future goals, and the needs of your dependents. This will guide you in choosing an appropriate policy.

Evaluate the offerings provided by your employer or association. Take note of coverage limits, premium costs, and any additional benefits that may influence your decision.

If you need guidance, don’t hesitate to get in touch with financial advisors, so you can ensure that your decision aligns with your overall financial plan.

Insurance professionals provide you with insights and help you choose a plan by considering the long-term implications of your life insurance choices.

Finally, always remember that your choice is personal, and with the insights gained from today’s blog, we are sure you will be well-prepared to get a life insurance plan that secures the financial well-being of you and your family.

Get your premium quotes in 60SECs

Did you find this article helpful? Share it!