How Government Auto Insurance Serves as a Lifeline for Low-Income Drivers in 2024?

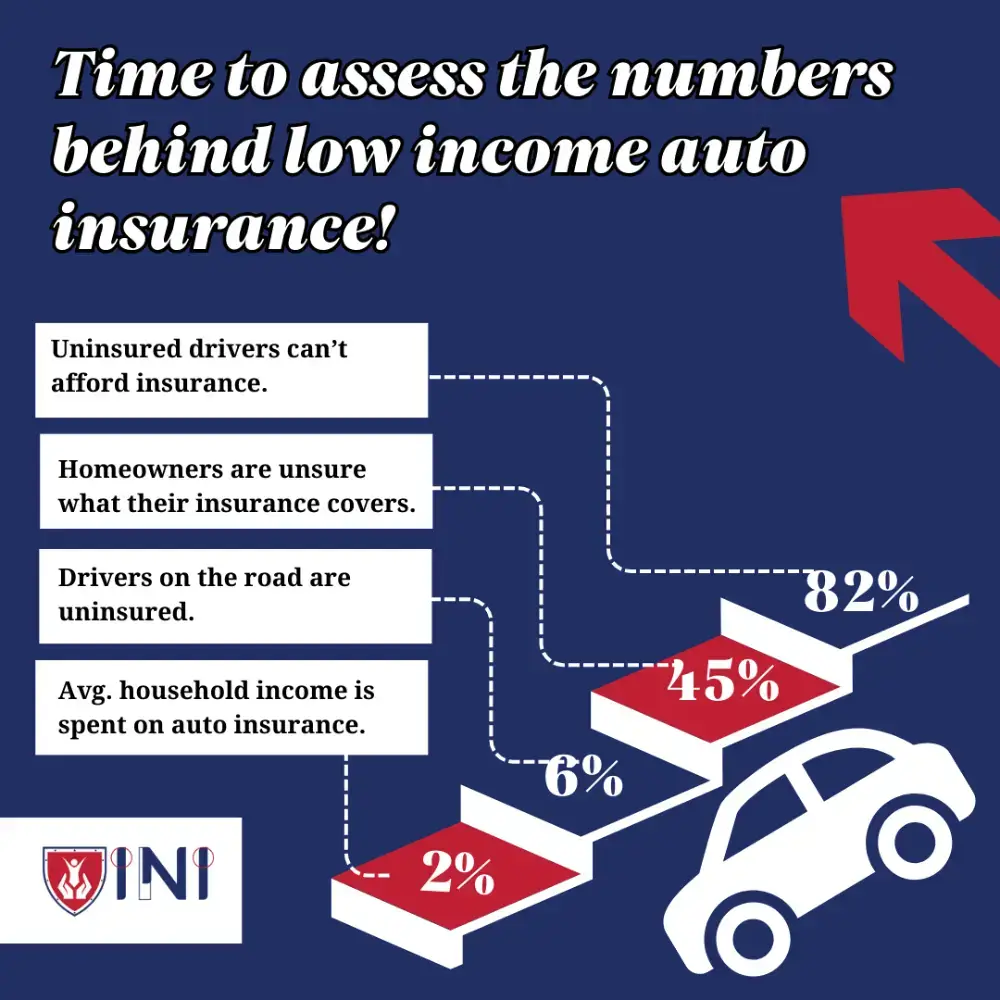

Did you know that 82% of drivers who are uninsured don’t have auto insurance as they can’t afford it? And most of the uninsured drivers are from either a low income group or don’t have an operable vehicle.

Financial constraints can prevent low income families from getting auto insurance. However, low cost government car insurance programs serve as a lifeline for low income drivers.

As we are about to enter the new year of 2024, in this blog we will highlight how low income individuals can benefit from government-sponsored auto coverage.

The need for basic auto insurance

Government auto insurance for low income individuals provides an affordable way to acquire car insurance for all low-income families.

The burden of insurance premiums can often be an obstacle for all those who want to hit the road without adequate coverage.

This forces individuals to make a tough choice between adequate auto insurance coverage and other basic necessities of life.

Getting your wheels on the road without basic auto insurance is unsafe for the drivers, passengers, and the public crowd on the road. If you belong to a low-income group, don’t worry, the government has got you covered.

All about government auto insurance programs for low income

With auto insurance costs on the rise, government sponsored auto coverage for low income is an initiative to prove and serve as a light of hope for low-income drivers.

This initiative was introduced to bridge the gap between affordability and necessity, recognizing the importance of auto insurance in the lives of low-income individuals.

Unlike private insurance, low cost government car insurance for low income people is driven by a broader purpose and they ensure that every individual, regardless of their economic standing, can access the protection they need on the road.

However, there are only three states in the U.S. offering state funded auto insurance programs for low income individuals. These states include California, New Jersey and Hawaii.

In order to qualify for low-income auto insurance, individuals must show proof of their low-income status. In the coming section, we will see how each state’s insurance works.

California’s low cost automobile insurance program (CLCA)

Who’s not a fan of California’s landscape? Whether you’re already residing in California or planning to move to California, this piece of information could help you.

-

CLCA was established by the legislature in 1999 to provide all low income individuals with liability coverage to meet financial responsibility laws.

-

The main aim of the CLCA program is to reduce the number of uninsured drivers by offering viable and affordable insurance options to those facing financial constraints.

-

One of the main features of this type of subsidized auto insurance is affordability. CLCA provides the necessary coverage to meet California's mandatory auto insurance laws, including liability coverage for bodily injury and property damage.

-

Individuals who opt for the CLCA program not only meet legal requirements but also have a decent level of protection that goes beyond the basic necessities.

To qualify for your program, an individual must meet household and income requirements, such as:

-

Have proof of address where you live & the car is parked

-

The vehicle’s value is a maximum of $25,000 or less.

-

The vehicle is not used for commercial purposes.

-

Annual household income is at or below 250% of the federal poverty level.

-

The driver has not met with any at-fault accidents in the past three years.

-

All the cars in the household are insured under CLCA.

New Jersey’s government auto insurance program

-

This particular low-cost government car insurance is also referred to as a Special Automobile Insurance Policy (SAIP) and has a simple and straightforward application process.

-

In order to enroll in New Jersey’s low-cost government car insurance program, individuals must be currently uninsured and already enrolled in a Medicaid program that includes hospitalization coverage.

-

Once these requirements are met, you qualify for dollar-a-day auto insurance that provides only medical coverage and not the state’s minimum car insurance requirements.

-

Apart from these, the state of New Jersey’s government assistance for auto coverage additionally offers a basic plan known as the New Jersey Automobile Insurance Plan (NJ PAIP). This program is offered to all New Jersey residents but it is quite expensive, as it offers comprehensive coverage.

To qualify for New Jersey’s low income based car insurance, individuals must meet below requirements:

-

Hold a valid driver’s license and drive a registered vehicle.

-

Don’t have an existing car insurance policy.

-

Currently enrolled in Federal Medicaid with a hospitalization program.

Hawaii’s government sponsored insurance program

-

This type of affordable car insurance for low income individuals is not as lenient as other state insurance programs.

-

The low cost government car insurance program is monitored and overseen by the state’s Office of Financial and Food Assistance Benefits.

-

Every individual who wants to receive benefits from government auto insurance for low income programs must be receiving federal supplemental security income or other financial assistance from the government.

-

In addition to this, if you’re already enrolled in the state’s Aged, Blind and Disabled (AABD) program, you are eligible for free car insurance.

To qualify for Hawaii’s government auto insurance for low income, individuals must meet the following requirements:

-

You are receiving government financial assistance and supplemental security income benefits.

-

You hold a valid driver’s license in Hawaii.

-

You are the sole registered owner of the vehicle.

Economical features of low income auto insurance

Government supported low income car insurance for low-income individuals is designed with distinctive features that set them apart from regular private insurance.

Understanding these features is crucial for individuals seeking affordable coverage in challenging financial circumstances.

-

Affordable premiums

-

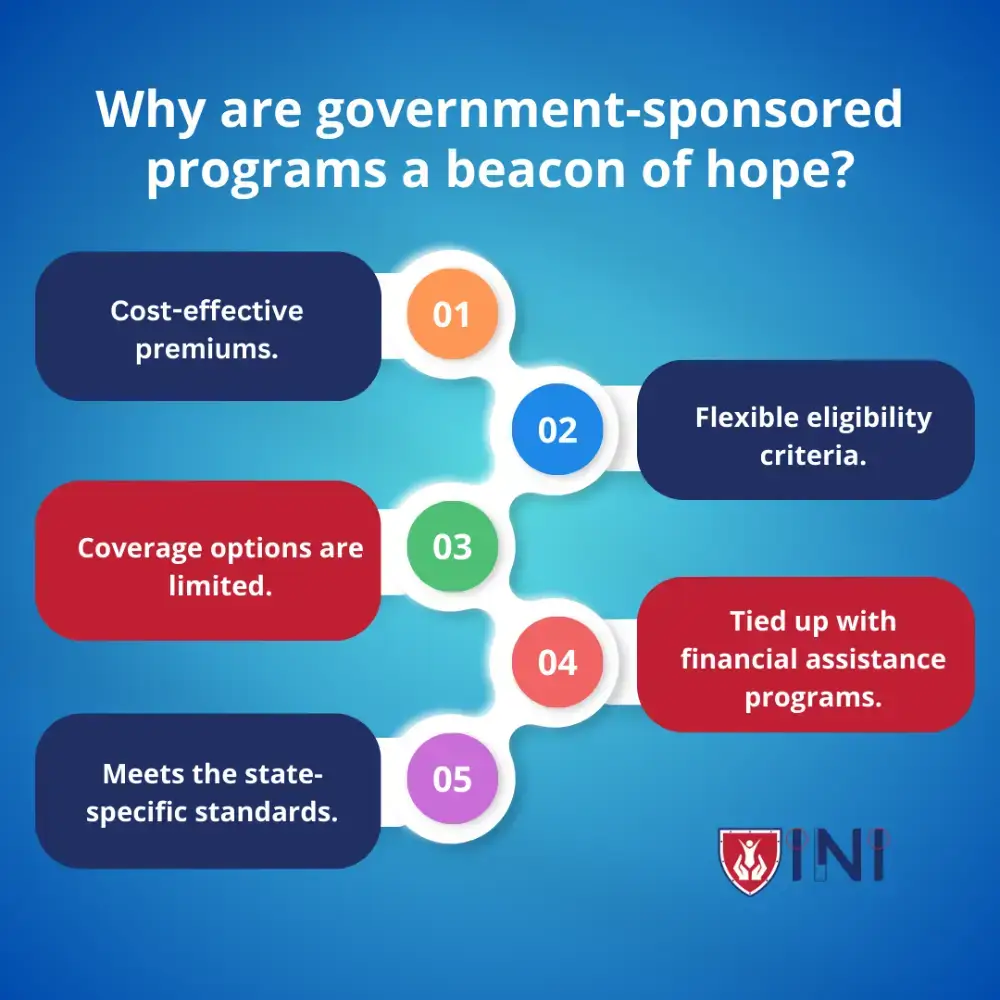

One primary feature of government auto insurance for low-income individuals is its cost-effective premiums.

-

Low income auto insurance programs provide essential coverage at rates that are more accessible for individuals with basic to limited financial resources.

-

-

Lenient eligibility criteria

-

All three state’s subsidized auto insurance for low income comes with specific eligibility criteria, often tailored to low income levels and participation in assistance programs.

-

This makes it easier for low income individuals to access the benefits of basic auto insurance coverage.

-

-

Limited coverage options

-

As low income auto insurance programs are cost-effective, the coverage options are limited. It covers only essential coverage as per the state’s requirements and may not provide comprehensive coverage options line private insurance plans.

-

-

Tie up with financial assistance programs

-

Many government-sponsored auto insurance programs are tied to financial assistance programs.

-

This means that individuals receiving supplemental income or other forms of financial aid may be eligible for these insurance benefits, creating a link between economic need and coverage.

-

-

Monitored and regulated by the state

-

These programs are usually overseen and regulated by state authorities, ensuring a level of consistency and adherence to state-specific standards.

-

This further helps in maintaining the safety of low income individuals irrespective of their affordability.

-

Comparison of government vs private auto insurance

Deciding between government auto insurance for low income and private auto insurance is a critical choice for drivers who are looking for affordable coverage.

Both options come with their own set of advantages and considerations, making it essential to weigh the factors that align with individual circumstances.

| Government auto insurance | Private Auto Insurance |

|---|---|

| 1) Government auto insurance often stands out as a more affordable option for low-income individuals. | 1) Most of the private auto insurance options are not affordable for low income individuals. |

| 2) Low income auto insurance programs focus on essential coverage that is mandatory by the state. | 2) Private auto insurance plans typically offer more flexibility and depth in terms of coverage options. |

| 3) These programs are targeted towards specific income levels and may require participation in assistance programs. | 3) Private insurers may have more varied eligibility requirements, potentially providing comprehensive coverage to a wider range of individuals. |

| 4) Government auto insurance programs are subject to state regulations, and eligibility criteria may vary from state to state. | 4) Private insurance companies operate within these regulatory frameworks, but they may offer more consistency in eligibility requirements across different regions. |

How to apply for government auto insurance

The application process for each state’s subsidized auto insurance program differs and involves a series of steps.

However, if you think it is a complicated process, don’t worry we are here to guide you through the process. Get your queries answered and get your affordable insurance coverage to hit the road with confidence.

Here’s how you need to prepare to apply for low cost government car insurance:

-

Understand your eligibility criteria

-

The first step for you is to visit the government website of your state and review the eligibility criteria. Understand the income thresholds, residency requirements, and any other qualifying factors.

-

-

Check your driver’s license

-

Ensure that your driver's license is valid and meets the requirements set by the program. Renew or address any issues with your license before starting the application process.

-

-

Participate in assistance programs

-

Certain low income government auto insurance for low income requires participation in financial assistance programs. So, ensure that you are enrolled and have the necessary documentation to prove your participation.

-

-

Gather your income information

-

Understand the income criteria for the eligibility of low income auto insurance programs.

-

Gather documentation, such as pay stubs or tax returns, to demonstrate that your income falls under the low level category based on the income limits set by the program.

-

Key takeaways

Government-sponsored offers cost-effective and basic coverage options for all low income individuals. Remember that auto insurance coverage is essential for not just drivers but also the general public on the road.

If you’re from another state and don’t have access to low income auto insurance programs, look for ways to reduce the premiums by providing proof of safe driving practices, and participating in private auto insurance discount programs.

Whether you’re opting for government auto insurance for low income or private coverage, your goal for 2024 must be to secure reliable insurance that is both affordable and comprehensive while adhering to state regulations.

Get your auto insurance quote today.

Did you find this article helpful? Share it!