Does Medicare cover Final Expenses and Funerals?

Funerals are a part of everyone’s life! While it may not be a comfortable discussion, acknowledging the reality makes living in the present easier. Planning your finances for the funeral is important so that your loved ones are not pressurized during times of grief.

But, the question on many minds is, does Medicare cover these final expenses and funerals?

In this blog, you will find answers to all your questions and learn tips on how to choose the cheapest final expense insurance.

Are final expenses and funerals covered by Medicare?

If you’ve been a Medicare beneficiary, you know that Medicare covers most of your healthcare costs and is beneficial in many ways.

Medicare helps you save time, and money while providing comprehensive coverage focusing on accessibility, and wellness of the beneficiaries.

Additionally, if the beneficiary wants to switch between the plans or alter their Medicare coverage, they can do so during the Medicare enrollment period.

To answer your boiling question, Medicare doesn’t cover final expenses and funeral costs. Instead, you can use a Medicare medical savings account (MSA). Let’s see what is included in MSA!

What is a Medicare medical savings account?

It is a type of consumer directed Medicare Advantage plan (Part C). An MSA is similar to a Health savings account (HSA) that is given to you by an employer. If you have an MSA plan, you can choose your healthcare services and providers.

Just like different Medicare parts, Medicare MSA also has two different parts. Under this plan, you get to decide if you’re responsible for paying for your healthcare services using your account funds or other funds you have.

-

High deductible health plan

-

This plan falls under the Medicare Advantage plan and it only covers your costs once a high yearly deductible is met which varies by plan.

-

-

Medical savings account (MSA)

-

Medicare allocates a particular amount of money each year, especially for your healthcare expenses. This amount differs depending on the Medicare plan you choose.

-

The money is then deposited into your MSA account once at the start of every calendar year.

-

That’s why getting a funeral insurance policy is important. They are specialized insurance plans that are designed to cover the costs associated with funerals and burials.

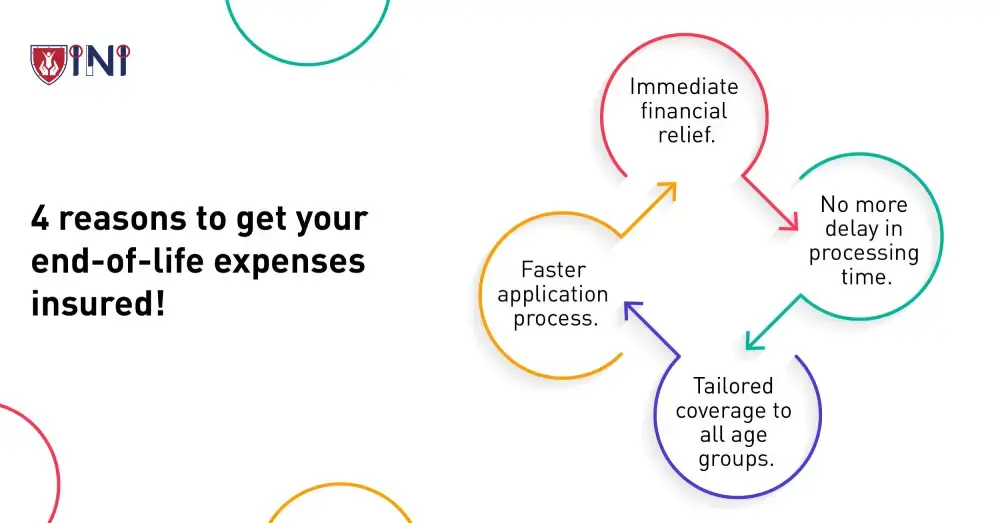

4 reasons to get a funeral insurance policy

If you’d like to receive a lump payment to meet all your end-of-life expenses, a funeral insurance policy is the best option. It has one of the most straightforward and simple application processes compared to other insurance policies.

-

Immediate access to funds

-

The funeral insurance policy provides immediate financial relief to meet your funeral expenses.

-

Unlike some life insurance policies that may take time to process, a funeral insurance policy ensures that funds are available promptly to cover immediate expenses associated with your passing.

-

-

Tailored coverage

-

These policies are specifically designed to cover every policyholder’s funeral and burial expenses, addressing the financial aspects based on their needs.

-

These kinds of tailor-made end-of-life arrangements may not be covered by other types of insurance plans.

-

This tailored coverage ensures that your loved ones are not burdened with unexpected costs during an already challenging time.

-

-

Accessible to all ages

-

A funeral insurance policy is accessible to young adults and elderly individuals making it a viable option for individuals of all ages. As a young adult, it would be more favorable to secure coverage than it is for elderly individuals.

-

-

Easy application process

-

As we mentioned earlier, the application process for funeral insurance is generally straightforward. Insurers have burial insurance no exam policy where you are not required to sit through a long medical examination in order to qualify.

-

The funeral insurance policy involves answering a few health-related questions, and in some cases, there may be no medical exams required.

-

This ease of application makes funeral insurance a convenient option for those seeking a quick and efficient way to secure coverage.

-

How to choose the best funeral plan?

Selecting the best burial insurance policy requires every individual to have a thorough understanding of their unique needs and preferences.

As you choose the best final expense insurance policy, here are the essential steps to help you make an informed decision.

-

Assess your financial situation

-

Starting with a financial analysis is always beneficial in the long run. Consider your monthly income, existing debts, and ongoing expenses.

-

This assessment will help you determine the coverage amount you need to ensure that your final expenses are adequately covered without insuring something that is not necessary.

-

There are affordable and expensive coverage options to choose from. Don’t exceed your affordability levels by getting attracted to the expensive coverage options.

-

-

Understand your health condition

-

The underwriting requirements of a funeral insurance policy are different from those of other insurance types. These policies may involve medical exams and your answers to health-related questions.

-

For your satisfaction, you can take up a medical examination to understand your health status and choose a policy that aligns with your specific situation.

-

If you have pre-existing health conditions, you may inform the insurance company and explore policies that offer more lenient underwriting.

-

-

Compare premiums

-

The end of life insurance coverage varies for every individual. What’s considered to be the best for you and me might not be the same for others. Premiums for final expense insurance policies can vary significantly between providers.

-

You can start researching premiums from multiple insurance companies and compare them, taking into account your budget and the coverage offered.

-

Be aware of policies with extremely low premiums, as they may have limitations in coverage or hidden fees.

-

-

Look for payout flexibility

-

The best final expense insurance policy is one that offers flexibility in payout options. This flexibility allows your beneficiaries to allocate the funds based on the immediate needs and circumstances at the time of your passing

-

Having control over how the funds are used adds an extra layer of customization to your final expense plan.

-

-

Consult with your financial advisor

-

Did you know that the average cost of a funeral in the United States can range from $7,000 to $12,000?

-

These costs tend to vary based on various factors such as location, type of service, and additional expenses. To make the process less overwhelming, it is advisable to consult with a financial advisor.

-

Insurance professionals from Indemnity National Insurance can provide personalized guidance based on your specific situation helping you choose the best final expense insurance in the market.

-

-

Examine policy terms and read reviews

-

Carefully read and understand the terms and conditions of your funeral insurance policy. Pay attention to any exclusions, waiting periods, or limitations that may impact the coverage.

-

In addition to that, reading customer testimonials and reviews can help you get the best final expense insurance from the insurance provider you are planning to deal with.

-

Burial insurance policy vs other types of insurance policies

| Funeral insurance policy | Other types of insurance policies |

|---|---|

| 1) The best final expense insurance is one that provides maximum memorial service coverage. | 1) Other insurance policies don’t provide a separate life insurance for burial. For instance, auto insurance provides coverage only for vehicle damages and bodily injury as it is meant solely for vehicles. |

| 2) Burial insurance plans are more accessible, for individuals irrespective of their age or health condition. They cover only final expenses and don’t provide long term support. | 2) Other insurance policies provide broader coverage that is not restricted to providing long-term financial support for beneficiaries. |

| 3) Offers a quicker payout than some traditional life insurance policies, ensuring immediate financial support. | 3) Payouts may take longer due to the comprehensive nature of coverage and the need for a thorough underwriting process. |

What’s included in the best burial insurance plans?

Knowing what’s there in a basic end of life coverage is more important than just mere customization of policies. We know that a final expense insurance policy is designed to cover the costs of burial arrangements.

But, aren’t you curious to know what the best final expense insurance policy covers? Well, here you go!

-

All the funeral arrangements, from embalming caskets to flowers and services.

-

Includes burial costs like cremation, burial plot, headstone, and interment.

-

Provides additional support in paying out outstanding medical bills and credit card bills.

To conclude

Medicare serves to provide safe and secure healthcare to all beneficiaries by covering all the costs associated with medical treatments. However, it doesn’t cover the comprehensive costs associated with end-of-life arrangements.

In order to fill these gaps, we advise you to get the best final expense insurance policy to ease the financial burden on your loved one

By understanding the nuances of funeral insurance, comparing it with other alternatives, and considering individual needs, you can now make informed decisions about the best final expense insurance based on your unique circumstances.

It is best to take control of your financial future when there are enough opportunities in the insurance market.

Get your affordable coverage now!

Did you find this article helpful? Share it!