A Comprehensive Guide to Disabled Veterans Life Insurance in California

Service-disabled veterans life insurance in California is one of the valuable initiatives taken by the U.S. Department of Veteran Affairs, aiming to guarantee that veterans with service-connected disabilities gain access to life insurance protection for their families.

We express our hearty gratitude for safeguarding our nation, regardless of the time or place.

Life after several service injuries can be challenging and the thought of protecting the family is a noble commitment. Join us today in this blog as we share the knowledge and resources needed to apply for disability insurance California.

Disabled veterans life insurance: Things to know

Life insurance plays a major role in the lives of service disabled veterans. The transition to civilian life can be difficult and this makes financial planning a top priority.

The service disabled veterans life insurance (S-DVI) is a government-sponsored, low-cost insurance also referred to as RH insurance is known to serve military veterans who have been disabled due to an injury or illness that occurred during military service.

Now that you know the purpose of life insurance for disabled veterans, let’s move on to discovering the 2 main types of life insurance for disabled veterans.

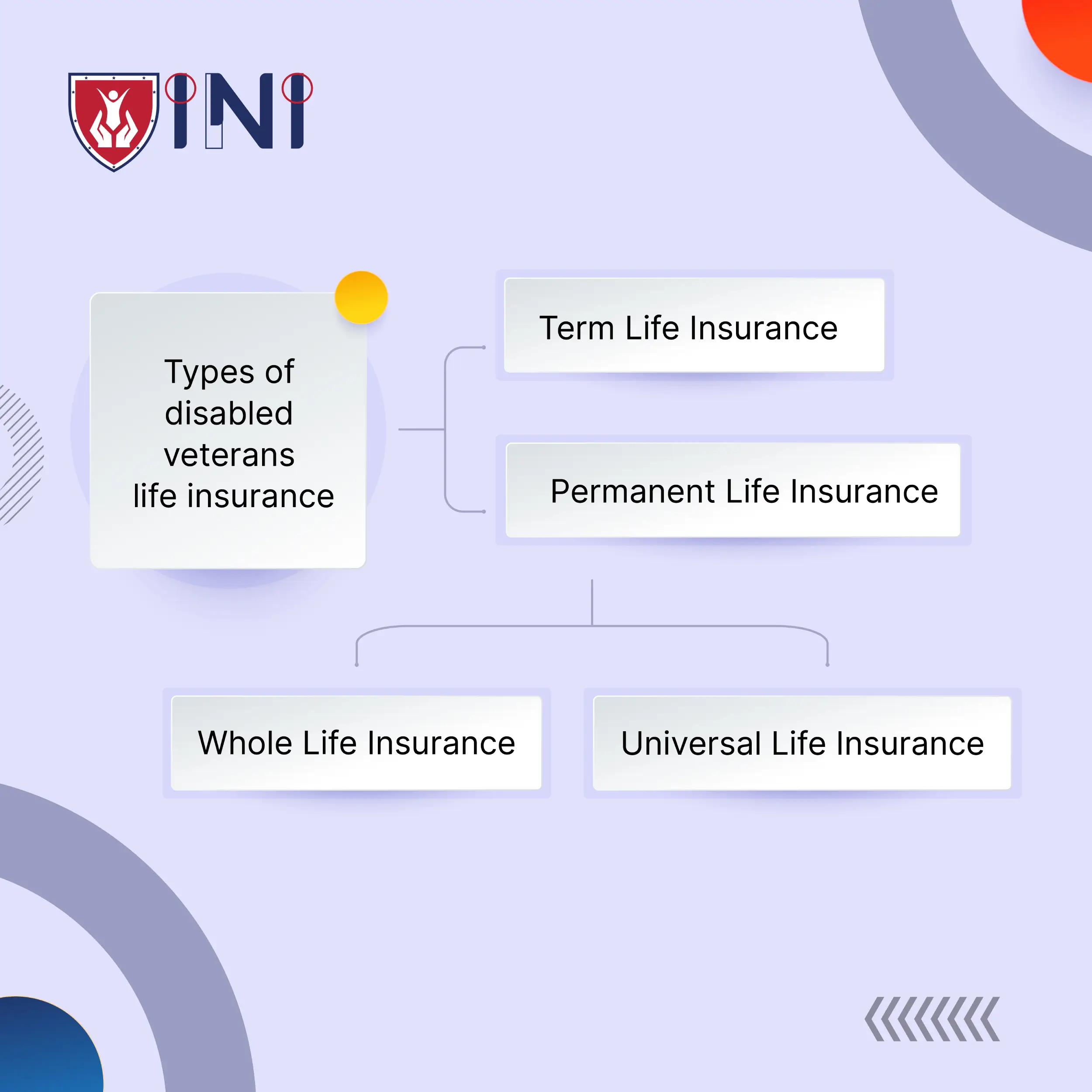

2 types of disabled veterans life insurance

Life insurance for disabled veterans covers various options tailored to meet the unique needs of veterans. In this part of the blog, we will look into the two primary types of life insurance for disabled veterans.

-

Term life insurance

This is a straightforward and cost-effective solution that provides coverage for a specified term.

Term life insurance is particularly beneficial for disabled veterans due to its flexibility and affordability, offering financial protection during transitional periods.

Veterans have the liberty to select a term that aligns with their needs, such as a specific number of years or until a significant life event, providing a customizable and budget-friendly coverage solution for their family.

-

Permanent life insurance

Whole life and universal life insurance are 2 types that fall under permanent life insurance, providing lifelong coverage and additional features such as cash value accumulation.

They are usually more expensive than term life insurance due to the coverage length and cash value accumulation feature.

This type of insurance caters to the long-term needs of disabled veterans, offering stability and financial benefits that extend beyond a specified term.

Let’s have a further look at their types below.

Whole life insurance

Offers lifetime coverage, ensuring protection for disabled veterans and their families.

Accumulates cash value over time, serving as a financial asset that can be accessed or borrowed against during times of financial need.

The good thing with whole life insurance is that you don’t have to worry about the premiums as they remain constant throughout the policy's duration, providing predictability and stability.

Universal life insurance

If you are someone who is looking for flexible life insurance coverage, universal life insurance will offer you just that. It allows you to adjust your death benefit and premiums within certain parameters.

This adjustment helps veterans adapt to the changing needs and financial situations of their families.

Accumulates cash value based on what type of universal life insurance you buy with the potential for investment growth.

Now that you have an idea about the available life insurance options, it is time to check if you qualify for the S-DVI in the next section.

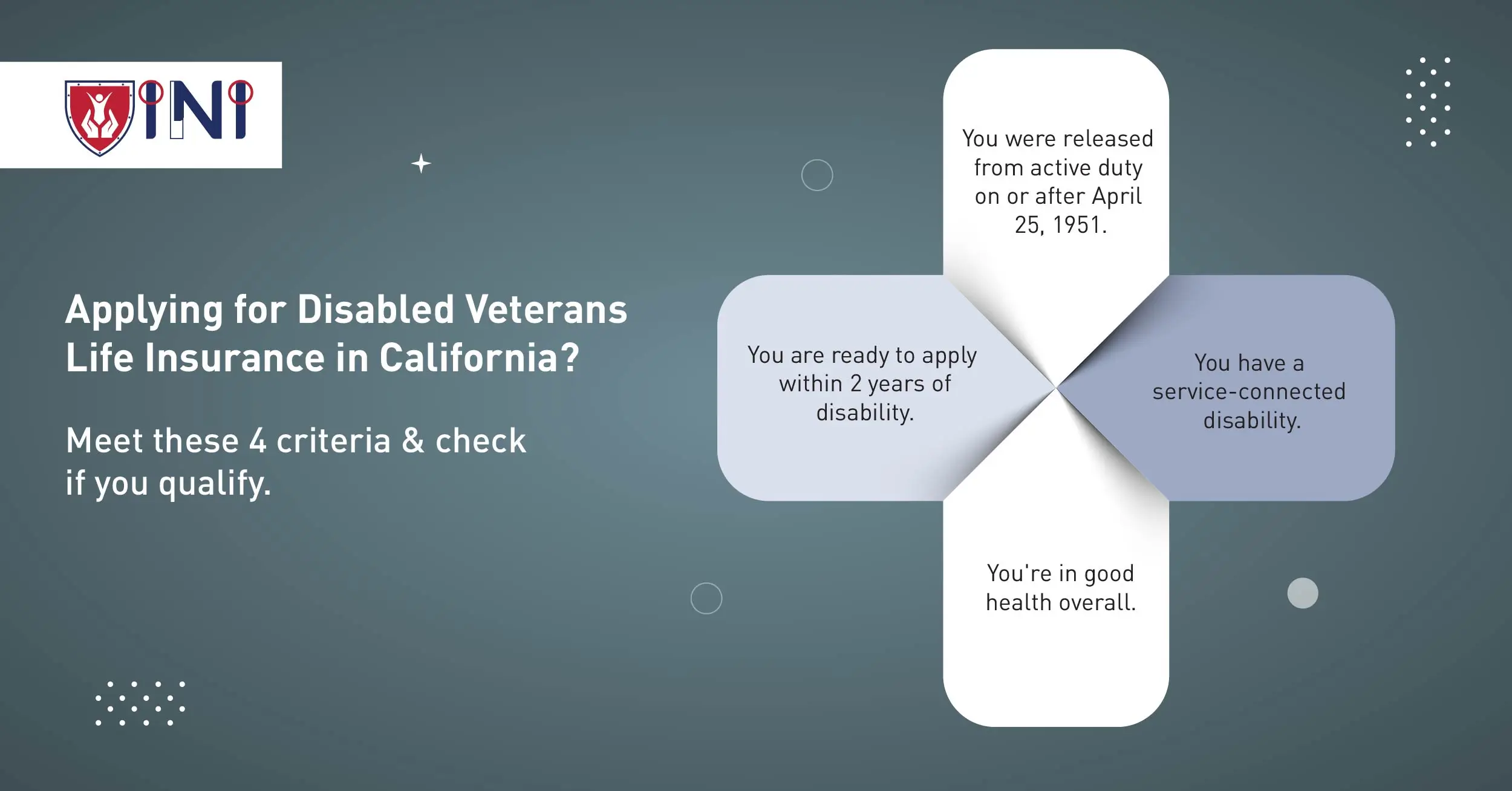

Do you qualify for S-DVI?

As we know, the service-disabled veterans life insurance program is committed to supporting all the brave men and women who have served in the military. To access the benefits offered by S-DVI, certain eligibility criteria must be met.

We will see if you meet these four requirements:

You have been released from active duty on or after April 25, 1951, with an honorable discharge.

Your disability has occurred while delivering your service.

You are in good health overall, with the exception of disabling conditions that originated during the service period.

You apply within 2 years of receiving your disability rating.

Please note that meeting the above requirements becomes crucial to start your application process.

Do you meet all the criteria? If yes, then you can apply online with the support of a personalized insurance executive from Indemnity National Insurance.

How does the S-DVI program work?

All the qualified disabled veterans will receive their life insurance amount ranging from $1,000 to $10,000, in multiples of $500. If you have any other government sponsored life insurance, the total amount of all the policies cannot be more than $10,000.

If you’re below 65 years and unable to work because you’ve been deemed completely disabled, you may qualify for the waiver of S-DVI premiums. It means that you don’t have to pay for the insurance premiums.

However, to gain the premium benefits, you must apply for the waiver as soon as the disability occurs while remaining totally disabled for at least 6 months to qualify.

In addition to that, you can apply for a supplemental S-DVI and receive $30,000. Here are the basic qualifications for the same:

You are below 65 years.

You currently have an S-DVI policy.

You will be applying for the coverage within one year of receiving the notice of premium waiver.

Other supplemental disabled veterans life insurance

The Department of Veteran Affairs additionally provides other supplemental insurance options for disabled veterans with a service-connected disability.

-

Traumatic injury protection

It cannot be entirely specified as life insurance as the coverage provides $25,000 to $100,000 as short-term financial support to help disabled veterans recover from a traumatic injury.

-

Veterans mortgage life insurance

This program serves as a mortgage protection insurance for families of veterans with severe service-connected disabilities who have adapted a home to fit their needs. They can get up to $200,000 in coverage.

These life insurance benefits are paid directly to your mortgage lender or the bank.

Dear veterans, Let’s now understand more about disability insurance in California!

What is disability insurance California?

The California State Disability Life Insurance (SDI) program provides short-term disability insurance along with paid family leave wage replacement benefits to eligible employees who need some time off from their work.

Disability insurance provides short-term benefits to eligible Californian employees who suffer wage loss when they cannot work due to a nonwork-related injury or illness or during a medical disability.

This is administered by the Employment Development Department and the funds from this insurance are funded through the employee payroll deductions.

Next, let us make sure that your employer meets the requirements below👇

What are the employer requirements?

Employers in California are required by law to inform their employees about the DI benefits while withholding and remitting their DI contributions. They need to provide information about the DI to their employees by supplying the below information.

-

Notice to employees - It advises their employees about the rights they have to claim unemployment insurance, DI and paid family leave benefits.

-

State disability insurance provisions - This is provided for new hires and informs them about their right to notify the employer when he/she needs time off from work due to a nonwork related medical condition.

What is your DI employee eligibility?

Disability insurance California has certain fundamental eligibility requirements that are essential for Californian employees to access the valuable DI benefits.

You are unable to do your regular work for at least 8 consecutive days.

You are employed or actively looking for work during the time of disability.

You have lost wages due to the disability.

You have earned a minimum of $300 from which DI deductions were withheld.

You are under the care or treatment of a licensed doctor or an accredited practitioner during the first 8 days of disability.

You are ready to complete and mail a claim form within 49 days of the date of your disability.

You have a doctor complete medical certification of your disability.

But, you might be ineligible for the DI benefits in the following circumstances

You are not suffering a wage loss.

You are receiving unemployment insurance or paid family leave benefits.

Your disability is due to committing a crime.

You are in jail, prison or a recovery due to your crime conviction.

You are receiving worker’s compensation benefits greater than the DI rate.

You fail to take an independent examination when you are required to do so.

If you meet all the above eligibility requirements, you will be receiving your CA disability insurance benefits through the state Employment Development Department and there is a 7-day waiting period until your benefits are paid to you.

Stay protected with Disability insurance

As we wrap up the blog, we would like to tell you that a key to disability life insurance planning lies in your understanding of the type of disability you have.

By understanding the specific types of life insurance, such as Term and Permanent Life Insurance, you can tailor your insurance options based on your family's needs.

Additionally, recognizing eligibility criteria for Service Disabled Veterans Insurance (S-DVI) and disability insurance California is crucial to begin your application process.

We hope our guide serves you with valuable information to understand disability life insurance for Veterans. We aim to assist all disabled veterans and provide continuous guidance so that you are equipped with all the information to make the right choice.

Get quality coverage for your family today.

Did you find this article helpful? Share it!