A Comprehensive Guide to Florida Condo Insurance Coverage

A perfect beachfront condo! Have you ticked it off your bucket list? If yes, congratulations! But, hey there’s one more thing to do, and that is getting condo insurance in FL to protect your spaces and belongings.

This blog will equip you with all the nitty-gritty details of buying condo insurance in Florida. Right from getting the cheapest condo insurance quotes online to tips on cutting costs, you will get every bit of information to get started.

What’s covered in condo insurance Florida?

Florida Condo Insurance typically covers your furniture and fixtures along with personal belongings that might get damaged in case of theft, fire, or gusty winds.

📃Here’s a detailed list of coverage types

-

Dwelling

As per Florida’s law, a regular condo association master policy, certain built-in fixtures of your condo units won’t be covered.

To ensure maximum protection for your units, dwelling coverage is highly recommended so that it is easier to replace if something happens.

Check this out, we have shared a list of what’s in dwelling coverage and what’s not covered.

✅What’s in What’s not in❌ Walls Electrical fixtures Countertops & cabinets Everything built into your condo unit Flooring or carpet Wall or ceiling coverings Appliances Water heaters or filters Drapes, blinds, or window treatments Hold on, though! Some items, like furniture and clothes, might have you confused. They could fall under personal property coverage instead. We'll dig into personal property coverage next!

-

Personal property

This coverage type can save all your things that have not been bolted to your units. So, in case a burst pipe ruins your vintage rug, personal property coverage has your back.

In simple terms, all things movable are covered with personal property coverage. Don’t forget to ask your insurance provider if your belongings are covered in their actual cash value or on a replacement cost basis.

✅What’s in What’s not in❌ Furniture Electronics Any other movable items Anything immovable and built-in within your units. [That’s dwelling coverage territory] If you feel like you need more clarity, no worries! Indemnity National Insurance is ready to guide you. If you’re unsure about coverage types and choosing the limits, contact us and we will clarify all your queries

-

Personal liability

Imagine that you’re hosting a party in your condo and your friend is accidentally injured or someone in the park sued you because your dog bit them.

Personal liability coverage steps right in such situations to save you from unnecessary legal actions and third-party medical expenses.

✅What’s in What’s not in❌ Legal expenses from claims Medical expenses Injuries happened to you Therefore, having personal liability coverage can save you a lot of costs and protect your assets from external damage.

-

Loss of use

They are also referred to as additional living expenses and help cover all your expenses if you are unable to live in your condo because of a disaster.

✅What’s in What’s not in❌ Lodging costs Transportation expenses Pet boarding Excess of restaurant bills Storage costs Laundry expenses Normal living expenses Costs exceeding policy limits 💡Quick reality check

Hurricanes are not new to Florida! You need a place to stay if your condo has been severely damaged right?

Instead of chipping in dollars from your pocket, a loss of use coverage helps you pay for the costs of lodging and transportation until your condo is restored to normalcy.

These are the main coverage types one can expect within their condo insurance in FL. Obviously, your costs will increase based on the depth of your coverage. Consider what kind of belongings you prefer to protect so that your insurance costs don’t go over your budget.

You will gain more clarity into this aspect as we discuss further about all the exclusions and the factors that influence your coverage in the upcoming sections.

Exclusions in condo insurance Florida

You will need to check with your insurance provider for additional coverage for the below situations as they are not included in your regular condo insurance policy.

Here are some of the listed scenarios👇

Flooding in your condo

Mudslides or earthquakes

Stagnant water from sewers or drains

Intentional injuries or damages

Termite and infestation damages

Don’t stress too much about these situations as they have a very rare occurrence. However, if you need clarifications, don’t hesitate to ask your insurance provider regarding the same.

We’ll now discover all the factors that affect your condo insurance costs.

Factors influencing condo insurance costs

If you have been living in the Sunshine State for some time now, you know that the state is famous for its year-round climate and diverse landscapes.

This means getting condo insurance quotes online is quite competitive. So before you reach out to your insurance provider, make sure to understand the factors that influence the costs of your condo insurance policy.

-

Location-specific risks

Florida is known for its sun-soaked days, and also for severe climatic conditions like frequent hurricanes and flooding.

If you're closer to the coast, you might face a higher risk of hurricane-related damages, while inland areas may contend with flooding. Your costs depend on these risk factors and the higher the risk, the higher your premiums will be.

Tailoring your insurance coverage to meet these location-specific challenges ensures you're adequately protected against the elements.

-

Age of your building

Older condos might be affordable, but they may come with different insurance costs compared to newer ones.

Older structures may have outdated electrical systems or plumbing, making them more susceptible to certain risks. You might end up paying a bit extra if you choose to buy older condos.

-

Coverage limits and deductibles

Reviewing and understanding your coverage limits and deductibles is important to finding the perfect coverage.

While higher limits offer more protection, they may also lead to higher premiums. If you choose to pay higher deductibles, then your premiums might be lower. Depending on your affordability, you can choose your deductibles

-

Count your belongings

Your condo isn't just a structure, it is a place where you live and stock up on your favorite belongings. So you need to take inventory and assess the replacement cost of your items to ensure that you're adequately covered.

Whether it's your expensive electronics, stylish furniture, or sentimental treasures, valuing your personal property will help you evaluate the value of replacing them if they’re damaged.

Understanding these factors will influence the type of condo insurance you choose and help you to manage your insurance budget accordingly.

Talking about budgets! Florida has some of the best condo insurance policies for all the condo homeowners who are looking for budget-friendly condo insurance policies.

If you’re one of those homeowners, take a closer look at the tips offered below!

Condo insurance Florida essentials

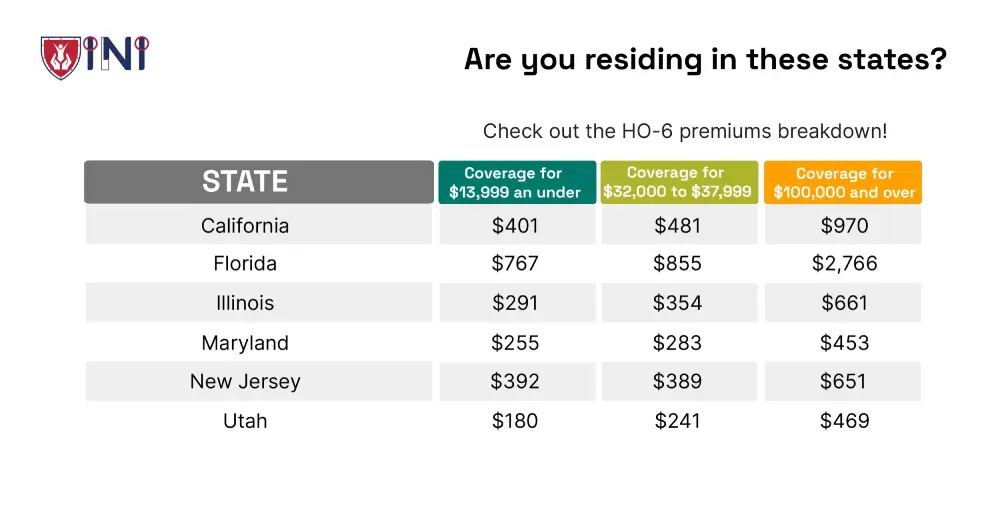

Condo home insurance – also referred to as HO-6 insurance, aims to provide ultimate protection specifically for condominiums. They are different from your regular homeowner’s insurance.

Keep reading to discover the why, shortly!

In other words, condo insurance Florida only covers all your units and belongings within the walls. The main difference between a homeowner’s policy vs HO-6 policy is that when you own a home, protection is needed for both the interiors and exteriors.

But, when you own a condo, you’re only responsible for all your personal belongings and the interiors. That’s where Florida condo insurance comes into the picture.

Condo living is quite challenging and protecting your interiors becomes primary. So, let’s go ahead and check out everything that’s covered by your Condo insurance.

5 Tips to lower your condo insurance costs

Let’s help your cut down those condo insurance costs so that you get to safeguard your belongings and afford a beautiful lifestyle in Florida.

-

Bundle up your policies

Manage all your policies without any confusion because bundling your policies helps you to deal with one insurance provider and eliminates multiple paperwork.

You can club your condo insurance Florida with other policies, like auto insurance. Many insurers love it when you bundle your policies, and they end up offering sweet discounts. It's not just convenient for you but also saves you some dollars.

-

Installing condo security systems

Safety first, savings second! Yes, that should be your mantra. Implementing safety features in your condo not only provides peace of mind to your family but also has the potential to lower your insurance premiums.

Systems like smoke detectors, security cameras, and impact-resistant windows can upgrade your condo and insurers will reduce your premiums as you demonstrate your responsibility toward protecting your spaces.

-

Maintaining a good credit score

Yes, your credit score isn't just useful in getting a mortgage; it's a potential money-saver when it comes to insurance as well! A good credit score showcases your financial responsibility and, in the eyes of insurers, makes you a lower risk.

Lower risk means lower rates. So, keep those credit habits in check, and watch your insurance premiums go down.

-

Join a condo association

Being part of a condo association isn't just about community spirit, but it can also lead to substantial discounts on your condo insurance.

You get to negotiate better deals for the entire group. It's a win-win as you get community perks and savings on your insurance costs!

-

Review and update your HO-6 policy

What worked for you last year might not be the perfect fit now. That's why an annual policy review is needed.

Circumstances change you might have acquired new possessions or renovated your condo. So, your policy should be updated to match your current lifestyle.

Stay proactive, keep your policy up to date, and ensure it provides the level of protection you currently need.

By incorporating these tips into your condo insurance strategy, you get to make smart choices that benefit both your lifestyle and your wallet.

How much condo insurance do you need?

As we close the blog, let’s have a quick discussion on how much condo insurance will be sufficient for your needs!

You need to purchase condo insurance coverage that:

-

Can replace your personal items

-

Can rebuild your existing space as it is, in case of severe damage

-

Can protect you from lawsuits, and cover the medical expenses in case of third-party injuries.

This choice is up to you and your preferences. Based on the inventory available in your condo, the insurance costs might differ.

Shop around and get quotes from multiple insurance providers to make sure that you get the right coverage that has a balance between affordability & comprehensive protection.

Get quotes that fit your wallets.

Did you find this article helpful? Share it!