11 hacks to find the best cheap car insurance in New Jersey?

Attention New Jersey residents!!! We have got the 11 hacks to find the best cheapest car insurance in NJ. You don’t have to pay hefty premium payments to get your car insurance.

In this blog, we will guide you through the process of choosing cheap car insurance quotes in NJ while procuring adequate coverage.

About car insurance in New Jersey

NJ is also referred to as the Garden State, where scenic nature views meet bustling cities. Despite being one of the smallest states in the U.S. the landscape is geographically diverse.

From farmlands, coastal regions, and suburbs to urban cities. Many residents in New Jersey choose to live in the state due to its close proximity to major metropolitan areas such as New York, Pennsylvania, and Delaware.

However, the cost of living, including expenses of car insurance, can be a challenge. It is crucial to find ways to cut costs without compromising coverage as the average monthly premium costs around $158 and the annual auto insurance premium costs around $1,895.

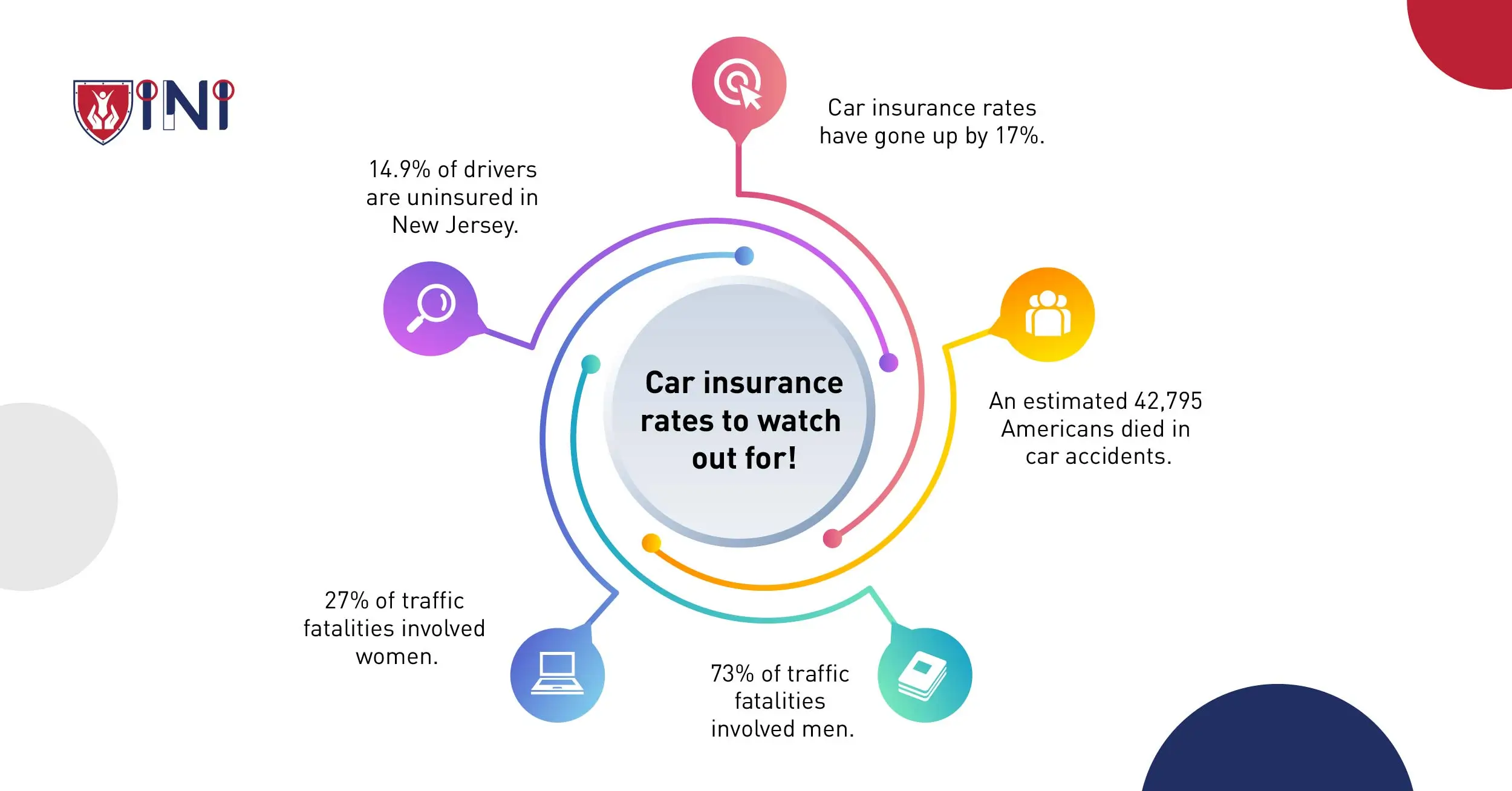

Factors influencing car insurance rates

Did you know that car insurance in New Jersey is expensive because it's a no-fault state with the highest population density of any state in the country? However, finding cheap car insurance in NJ is possible!

But before that, let’s identify some of the factors that influence the hike in insurance rates.

-

High population density

An increase in the number of residents means more cars on the road, which leads to increased competition for insurance coverage. Due to this, the premiums tend to be higher.

-

Traffic congestion

The state's heavy traffic congestion contributes to a higher risk of accidents, impacting car insurance rates.

However, in the interior parts of New Jersey, traffic patterns may change and the premiums decrease.

-

Urban vs. rural areas

If you’re located in the urban hub of New Jersey, insurance rates might be higher due to increased risks and traffic.

Residents in rural locations may enjoy comparatively lower premiums, as the reduced traffic and lower frequency of claims mitigate some of the inherent risks associated with urban living.

-

Age

Your insurance rates vary based on the age factor as younger drivers tend to pay more insurance costs due to less experience and higher chances of getting involved in an accident.

Drivers who are above the age of 25 can get lower premiums as they are observed as experienced drivers and less prone to accidents.

-

Car model and features

If you own a cheaper car, there are chances for you to secure cheap car insurance in NJ due to the very basic features present in the car.

But, if you own an expensive car and it has higher safety ratings, you can negotiate for discounts even with higher premiums.

-

Driving history

While calculating the premiums, insurers take into account your regular driving habits.

If you have a clean and safe driving record, your chances of finding cheap car insurance in New Jersey are higher than drivers with a harsh driving history.

-

Traffic violations

Drivers who have multiple violations are observed as higher-risk customers. This can increase the cost of insurance up to 20% to 200% depending on the level of violations.

11 hacks to find cheap car insurance in NJ

In a busy city like New Jersey, securing affordable quotes can be quite an overwhelming task. But don’t you worry! We have got a compilation of 11 clever hacks to get cheap car insurance in NJ.

-

Shop around to compare

-

Finalizing your coverage within the first quote you receive could be one of the biggest mistakes. Here’s why- Different insurance companies will have varied methods of setting insurance rates for drivers.

-

When you take time to shop around and compare quotes from multiple insurance providers, you will be able to find the best deals that fit into your budget while providing the required coverage.

-

Set your standards high, take time, and shop around for the best low-cost auto insurance in New Jersey.

-

-

Bundle policies

-

Combining your auto insurance policies with other policies such as homeowners or renters insurance helps you find discounts if you’re looking for budget car insurance quotes NJ.

-

These insurance discounts can help you save thousands of dollars on your overall insurance premiums.

-

Additionally, bundling your policies helps in dealing with a single insurance provider for multiple types of coverage, eliminating the need for multiple paperwork.

-

Hence, bundling policies is a cost-effective hack policyholders can use while shopping around for car insurance quotes in NJ.

-

-

Maintain a good credit score

-

It could be a surprise to some, but your credit score can impact your car insurance rates.

-

Having a good credit score demonstrates financial responsibility and can help you access cheap car insurance in New Jersey.

-

So, checking your credit report and taking the necessary steps to improve your scores will help increase your creditworthiness ultimately helping you get the best insurance rates.

-

-

Stick to safe driving practices

-

The price you get for obeying the traffic signals, using a seat belt, and avoiding phone calls can help you get cheap car insurance in NJ.

-

A clean driving record, free from accidents and traffic violations, is a powerful negotiating tool when seeking affordable coverage.

-

-

Choose a higher deductible

-

Lower deductibles require you to pay higher premiums whereas opting for a higher deductible can lower your monthly premiums. We’ll explain an auto insurance deductible.

-

It refers to the out-of-pocket expenses the insurer is ready to pay on a claim before the insurance starts covering it.

-

-

Enroll in defensive driving courses

-

If you are really determined to reduce your insurance rates, go the extra mile and enroll yourself in a defensive driving course.

-

This enhances your driving skills and helps you qualify for insurance discounts.

-

But, before enrolling in the driving course make sure to check with your insurance provider to see if they offer reduced rates for course completion.

-

-

Buy and drive a cheap car

-

The type of vehicle you drive influences your insurance rates. Cheaper, and reliable cars often come with lower insurance costs.

-

However, don’t miss out on prioritizing the safety features in the car as these features can also result in lowering the car insurance costs.

-

-

Inquire about discounts

-

If you are in need of discounts, simply ask the insurance officer if they have any discounts that you are eligible for.

-

Insurance companies offer various discounts, from good student discounts to military discounts.

-

Inquire about all potential discounts and make yourself eligible for them while taking advantage of these opportunities to save.

-

-

Make premium payments annually

-

Annual premium payments help in planning for other expenses and avoid the risk of missing monthly payments.

-

Additionally, it is also easier to secure discounts while you pay bulk premium payments.

-

Although it comes with additional fees, if your budget allows, consider paying your premiums annually to avoid these extra costs and late fees.

-

-

Install anti-theft devices

-

Inquire with your insurance provider if they provide discounts on premiums if you install anti-theft devices.

-

These devices can help you in many ways apart from securing discounts, like reducing the risk of your car parts being stolen and the probability of filing theft-related insurance claims.

-

-

Ask about usage-based Insurance

-

Apart from safe driving habits, if you’re an infrequent driver, this option can result in substantial savings.

-

Insurers use telematics to monitor and assess your driving habits to track various metrics such as miles driven, speed, braking patterns, and time of day when the vehicle is in use.

-

We agree with the difficulties you might face while looking for cheap car insurance in NJ, but implementing these hacks can make a significant difference in your overall insurance costs.

Remember, it's not just about finding the cheapest option but also ensuring that the coverage meets your needs.

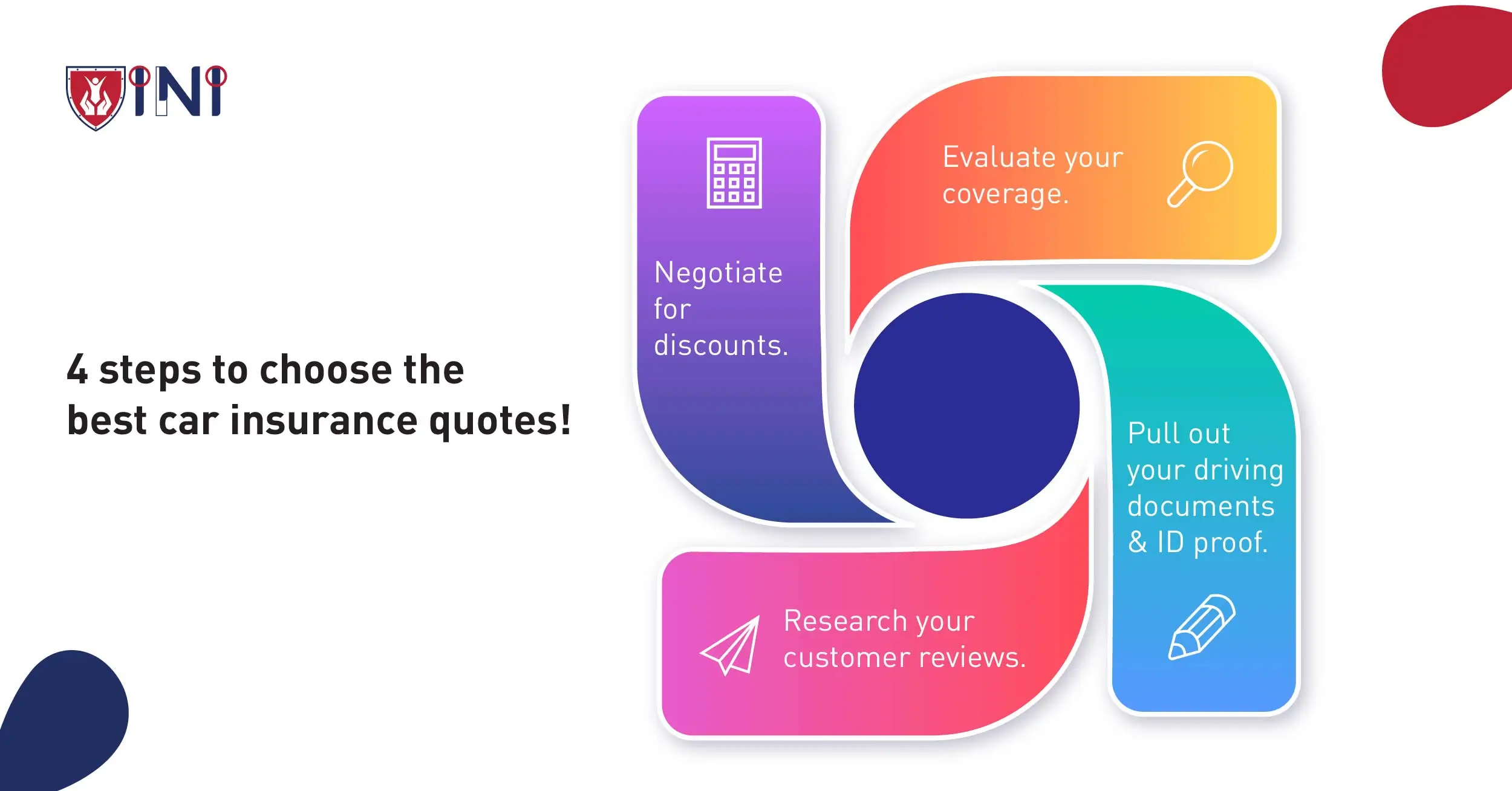

Process of choosing cheap car insurance quotes

Here’s a step-by-step guide to selecting the best car insurance at a reasonable price:

-

Assess what needs to be in your coverage

-

Evaluate your specific car insurance needs. Consider factors such as your driving habits, the value of your vehicle, and the amount of deductibles you will be ready to pay.

-

This assessment will serve as a foundation for identifying the most suitable and cost-effective insurance options.

-

-

Gather relevant information

-

Collect all your driving information such as your vehicle details, past auto insurance documents, and other government ID proof your insurer requires.

-

If you’re confused about the documents you need to gather, get in touch with insurance experts from Indemnity National Insurance to receive complete guidance and advice throughout the application process.

-

Having this information readily available streamlines the comparison process of car insurance quotes NJ.

-

-

Look for customer reviews

-

Real-world experiences from other policyholders can provide insights into the company's customer service, claims process, and overall satisfaction.

-

These reviews allow you to align the feedback with your specific priorities and tailor your assessment based on your unique preferences ensuring a more personalized and relevant decision-making process.

-

-

Check your discount eligibility

-

Many insurance companies offer discounts for factors such as safe driving records, bundling policies, good student status, or having safety features in your vehicle.

-

Understand if you qualify for these discounts. If not, try to become eligible and reduce your monthly premiums with driver discounts.

-

To conclude

Finding cheap auto insurance quotes in NJ is not as complicated as it sounds. With the right strategies in place, all the drivers will be able to achieve cheap car insurance in NJ.

From comparison shopping to leveraging technology, exploring discounts, and considering unique coverage options, these hacks empower you to take control of your insurance costs.

So hit the road with confidence knowing that you are saving on insurance costs while getting adequate coverage.

Be the first to get your free quote!

Did you find this article helpful? Share it!