The Benefits of Buying Final Expense Insurance at a Younger Age

You might have heard of the phrase “Life is an adventure!” and adventure essentially has an equal amount of excitement and uncertainties. Life is all about embracing every situation with open arms. As young adults, life can throw a lot of stuff at you, right from being independent and moving out, to managing the finances. It is a period of self-discovery and exploration.

As we have all witnessed the evolution of the economy and circumstances, it is advisable that young adults prepare their minds to face life’s eventualities. This is why young adults need to navigate a way to get a life insurance policy, especially a final expense insurance for themselves. Although it is quite unpleasant to prepare for end-of-life affairs at a younger age, it is key to leading your living years with ultimate peace knowing that your family will receive the utmost financial support during your funeral.

It more or less works this way - You safeguard your future and live your present with sheer will of happiness without having to worry about the finances. Remember that purchasing a final expense insurance for young adults is not only a wise financial choice but a thoughtful way to ensure that your loved ones are taken care of.

So, let us get to exploring the benefits of signing up for final expense insurance at a younger age and learn more about easy ways to find the best final expense insurance.

“Nothing in life is to be feared, it is only to be understood. Now is the time to understand more, so that we may fear less.”- Marie Curie

Fundamentals of Final Expense Insurance

Final expense insurance is one of the most sought-after insurance under the life insurance bucket. It is also referred to as funeral, or burial insurance that helps meet the rising costs of funeral expenses such as funeral arrangements, burial costs, including interment, cremation costs, medical bills, and some outstanding debt.

What differentiates final expense insurance from other life insurance policies is that they are specifically tailored to meet these end-of-life financial needs, unlike regular life insurance which offers broader payouts and coverage options.

Traditional life insurance vs. Final expense insurance

| Traditional life insurance | Final expense insurance |

|---|---|

| 1) They replace income and provide long-term financial security for dependents. | 1) They cover immediate costs that are involved in the policyholder’s funeral. |

| 2) The coverage that is being offered comes in larger amounts and they are focused on providing financial security for the policyholder’s dependents. | 2) This policy offers lower coverage amounts to specifically meet only the policyholder’s end of life needs. |

| 3) The premiums are generally higher due to the higher coverage amounts involved. | 3) Their premiums are usually affordable and budget-friendly. |

Revealing final expense insurance facts

53% of women say “paying for burial expenses” is the top reason they have life insurance, compared to 44% of men.

52% of American adults have at least some life insurance, while 48% don’t have any at all. Young people and those with lower incomes are less likely to have life insurance.

30% of Americans think burial and final expenses are all that life insurance covers.

Benefits of final expense insurance at a younger age

As mentioned above, giving importance to final expense insurance is important irrespective of your age. In order to maximize the benefits of final expense insurance, it is best to get started at a very young age. Enjoy the exclusive access of locking in lower premiums. Let’s see why this is a smart and best forward-thinking decision:

-

Financial security for loved ones

-

This is one of the main reasons why you should get final expense insurance when you’re this young. It provides financial security to your loved ones. In the event of your expiry, your policy's death benefit can be used to cover not just funeral and burial costs but also medical bills, and other outstanding debts.

-

This means that your family need not shoulder the expenses during an emotionally challenging time. It is one of the thoughtful ways to protect your loved ones during the hard phase.

-

-

Affordability for young adults

-

It is said that the cost of insurance premiums is primarily influenced by age and health status. When you’re younger you can tap into this benefit. The amount of health risks that a younger person is exposed to is potentially lower than elderly people.

-

So, you get to pay the lower premium amount by purchasing final expense insurance in your twenties or thirties. This increases your ability to afford not just an insurance policy but also allocate funds for other investment and emergency purposes.

-

-

Locking in low premiums

-

As discussed earlier, low premiums can be locked in by those individuals who are in their twenties and early thirties. The insurance costs for final expense insurance remain stable and don’t fluctuate, unlike other traditional insurance policies.

-

This essentially means that your insurance premiums stay the same throughout the life of your policy. It helps make you informed decisions and offers peace of mind knowing that your policy remains the same irrespective of your age.

-

So, why wait until your sweet 30s to pass in order to get a final expense insurance, when you can get it in your 20s? We will learn more about the advantages of planning ahead for the future in the coming sections, discover time-saving ways to find the best final expense insurance, and also learn why final expense insurance is the best life insurance for young adults.

What are the expenses involved?

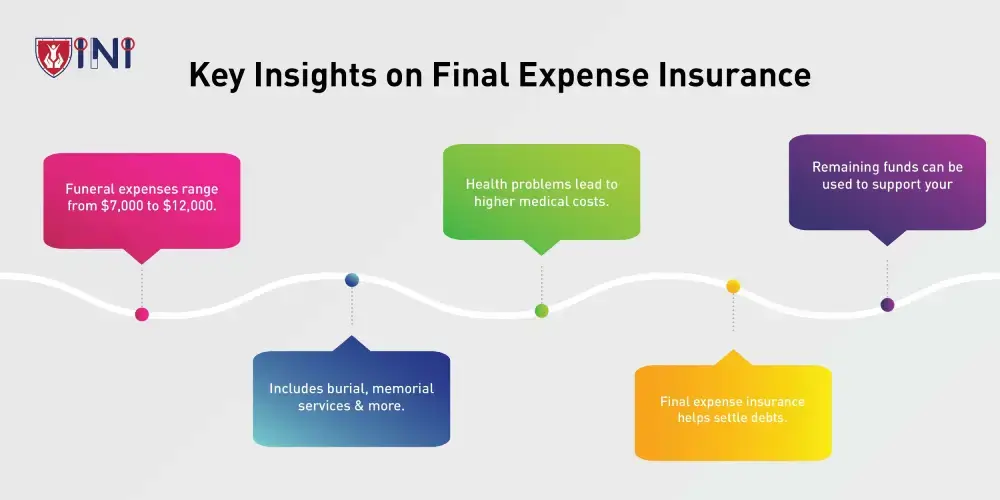

Talking about expenses - The main purpose of purchasing final expense insurance is to meet the end of life expenses without any financial burden during emotional distress. Some of these expenses include funeral arrangements, burial costs, including interment, cremation costs, medical bills, and some outstanding debt. Let’s see how getting an insurance policy will help meet these expenses with ease.

-

Funeral costs

Services offered during the funeral of an individual come at a certain cost and have been on the rise since the start of 2023. It ranges anywhere from $7,000 and $12,000. The cost of funeral arrangements, burial, interment, and cremation costs come under funeral costs.

Additional services involved in this package are embalming, caskets, cemetery plots, and memorial services. Purchasing final expense insurance ensures that your loved ones won’t have to make use of their savings or look for funds from other parties during emotional times.

-

Medical bills and debt

People who have severe health problems can leave behind bulky and expensive medical bills which ultimately must be paid by the existing family members. Without proper coverage, these financial obligations are really difficult to manage. So, make sure to guard your family from such stressful situations. Be it medical bills or outstanding debts, settle these financial responsibilities.

As we talk about the predictability of such situations, it is also important to note that some of the policy’s payout might have some funds remaining after funeral and debt expenses are settled. These funds can be used to support your children’s education or their expenses. Additionally, depending on personal interests, it can also be used to contribute to a charitable cause.

Eligibility requirements

The process to qualify for final expense insurance is straightforward and doesn’t require much documentation. Here is what you will need:

-

Health considerations

The primary factor for determining the eligibility and premium rates is ‘Health’. The reason why there is an influence of younger age individuals over elders in securing affordable premiums is because of their age.

It is believed that younger people will be in greater health with limited health issues and medical conditions than older people.

This helps you as a young adult to secure a policy with competitive rates and comprehensive coverage options. Make sure you take care of your health to secure a lower premium.

-

No medical exam policy

-

Final expense insurance policy often undergoes a simplified underwriting process and doesn’t require you to undergo a medical examination. This policy attracts younger individuals to insure themselves without the hassle of medical tests.

-

You are required to fill up a questionnaire that requests your basic health information, and the approval is faster compared to other traditional insurance policies. This removes any barrier of delay in the medical examination process and ultimately focuses on protecting their loved ones.

-

3 time-saving methods to choose the best final expense insurance

Shopping for the best final expense insurance shouldn’t be as difficult as you think. It is considered to be one of the best life insurance for young adults due to its simplified application process and eligibility criteria. We have made it extra simple for you so you can save some time, here you go:

-

Be on the lookout

After reading this blog, head over to the search engine and type “best final expense insurance in (your current state of residence)”. Once you get the results, go through the best insurance company’s websites, their reviews, and their coverage options. Get in touch with them personally or visit their branch nearest to you. Once you seek enough information, you should be able to think smart and make the best choice.

-

Use online comparison sites and tools

We are in an era where there are abundant options online. There are several websites that allow you to assess the best final expense insurance from various providers. Using these tools and resources can give you side-by-side comparisons, and help you efficiently narrow down the available options and identify the best life insurance for young adults.

-

Get a consultation from insurance agents

While you can maximize the utilization of these online tools, it is best to receive consultations from experienced insurance agents to get personalized recommendations based on your current circumstances. As they have in-depth knowledge of the field, it will be easier for you to decide. They can help you by offering a curated list of the best life insurance for young adults after assessing your financial goals and health status.

Implementing these 3 methods can help you save time and select the right final expense insurance policy.

To conclude

In 2023, options in the insurance market are abundant. There are several policies that help individuals secure every part and phase of their life. In the same way, purchasing the best final expense insurance for young adults is a confident and compassionate financial decision. It provides much needed financial security for you and your family.

Young adulthood is the best time to lock in lower premiums that remain stable throughout the policy period. Don't wait to make this crucial decision, it’s important for you to take the initiative today to secure your family's peace of mind and eliminate their financial burden.

Get your affordable quote here

Did you find this article helpful? Share it!