What Does Condo (HO-6) Insurance Cover?

You have moved into the best condo in your favorite city. New spaces and new neighbors. But have you thought about protecting your investment with the best condo insurance?

Yes, it is important as condo living comes with a unique set of advantages and challenges.

In this blog, we will help you understand everything about Condo insurance, and let you know what is covered so that you get to choose the best condo insurance coverage and ensure that your living space is protected.

Master the basics of condo insurance

Condo insurance, also referred to as an HO-6 policy, is different from homeowners insurance. Unlike homeowners insurance, condo insurance focuses entirely on protecting your unit and personal belongings.

Condo insurance coverage acts as special protection for people who live in condos, and it understands that condo living is different, so it gives you the right set of options to protect your condo space.

In simple terms, condo insurance only covers everything inside your walls!

Once you’re done grasping the basics of HO-6 insurance, the next step would be to understand the 4 main coverage options of condo insurance.

4 useful condo insurance coverage options

Living in a condominium requires sufficient maintenance. With living expenses steadily increasing, it is quite difficult to afford the condo’s maintenance, damage, and repair.

But, don’t you worry! There are condo insurance coverage options that help you deal with the damages to your personal property.

-

Dwelling coverage

Dwelling coverage within a condo policy typically protects the structure of your individual unit.

If, for instance, there is fire damage to the walls or flooring inside your condo, dwelling coverage steps in to cover the repair costs.

It's good for you to understand the limits and exclusions within this coverage to ensure adequate protection.

-

Personal liability coverage

Liability coverage can help you meet the costs of another injured person in case you're found responsible for injuring them or damaging their property.

Ask your insurance provider and learn about the incidents it covers, and how to determine the appropriate coverage limits for your specific situation.

The liability coverage stands as a core component of any H-06 policy and most of them provide at least $100,000 as a coverage amount. But, you are free to purchase more based on your requirements.

-

Personal property coverage

If your favorite personal property is damaged, this coverage will come right in to help you revive your personal belongings within the condo, such as furniture, electronics, and clothing.

The total amount of coverage you need entirely depends on the value of your belongings. You can start by taking an inventory of the costs it would take to replace all your belongings.

-

Additional living expense coverage

Imagine your condo becomes temporarily not fit to live in due to a covered event. ALE coverage steps in to cover the costs of alternative living arrangements until your condo becomes readily available for you to live in without any constraints.

This coverage is meant to cover all the difference between usual household expenses and the new extra expenses.

Some of these expenses are hotel bills, replacement clothing, everyday restaurant meals, laundry service, pet boarding, and storage

These coverage options serve as a light of hope to save your favorite condo from damage.

Before moving on to further sections, we would like to tell you that these coverage options vary from one insurance company to the other and it is best that you review every coverage carefully before finalizing.

3 quick ways to choose the best condo insurance

When it comes to selecting the right condo insurance coverage, policyholders usually look at affordability more than comprehensive coverage. But, the right condo insurance is one that has a balance of both affordability and adequacy.

Here are 3 ways in which you can make sure that your HO-6 insurance has everything right for you.

-

Research & compare

Before settling on a condo insurance policy, invest time in thorough research. Explore offerings from multiple insurance providers, paying close attention to the details of each policy.

Consider factors such as coverage limits, deductibles, and any additional features offered. Customer reviews and ratings can give you a picture of how condo insurance coverage works.

💡Bonus tip - To make your research process easier, utilize online tools and comparison websites. They help in providing a side-by-side comparison of different policies, making it easier to identify the one that best suits your needs.

-

Check your coverage limits & deductibles

We get it, it might be tempting to opt for lower coverage limits to save on premiums.

But as we highlighted earlier, it's essential to strike a balance. That can be done by understanding the coverage limits and deductibles within a condo insurance policy.

Assess the value of your condo interiors and possessions realistically. Consider potential repair or replacement costs in the event of damage or loss.

See how a deductible impacts your out-of-pocket expenses. Check if they increase or decrease your claims.

💡Bonus tip - Consult with insurance professionals or simply enter your zip code in Indemnity National Insurance’s online form to quickly estimate the appropriate coverage limits based on your specific circumstances.

-

Customization lies in your hands

No two condos are alike, and the best condo insurance companies will offer coverage that helps cover the unique features of your living space.

Customize your policy to align with your lifestyle, the value of your possessions, and any specific risks associated with your location.

If your condo has unique features or you own high-value items, ensure that these aspects are adequately covered in your HO-6 policy. This ensures that you get comprehensive protection without unnecessary expenses.

💡Bonus tip - Don't hesitate to ask your insurance provider about available add-ons that can enhance your coverage.

Whether it's additional coverage for valuable items or specific protections for condo-specific risks, asking for an add-on gives you an extra layer of security.

Buckle up, readers! We now have with us three quick and effective ways to guide you through the process of choosing the best homeowners insurance for condos.

But wait, the blog doesn’t end here. Stay tuned for some common misconceptions and the inside scoop on what’s included in your condo insurance policy.

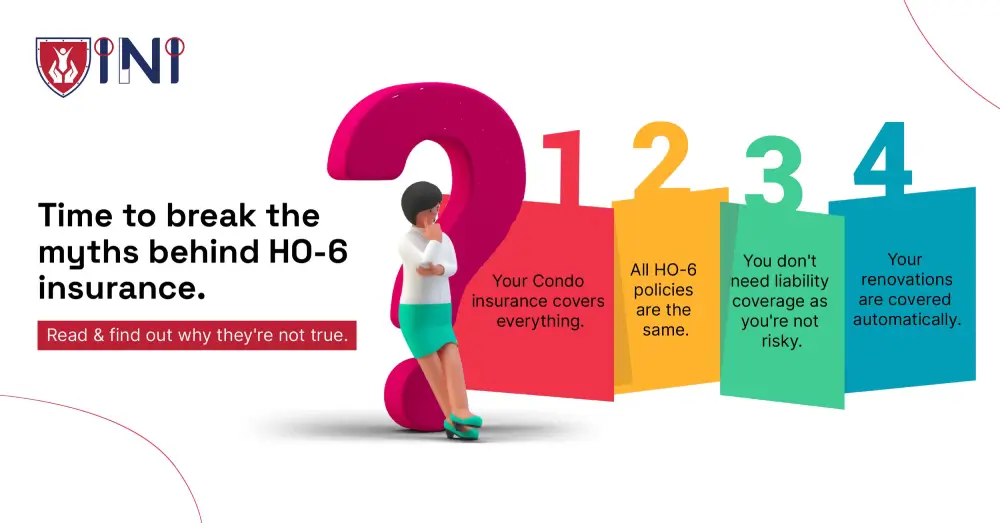

Addressing misconceptions about HO-6 insurance

It’s time to debunk some myths that people believe are true! Let’s break them all so that you move ahead with confidence.

Myth #1 - My condo association's insurance covers everything

It's a common belief that a condo association's insurance policy provides comprehensive coverage for all aspects of your living space. However, this is far from the truth.

Condo association insurance typically covers the building structure and common areas but might not extend to your unit or personal belongings.

Myth #2 - All condo insurance policies are the same

Absolutely false. Not all condo insurance policies are created equal. Assuming they offer identical coverage can lead to significant gaps in protection.

There are differences between policies, coverage limits, deductibles, and additional features.

Understanding this will help you choose a policy that aligns seamlessly with your unique needs and provides the right level of protection for your condo.

Myth #3 - I don't need liability coverage as I'm not at risk

Liability coverage is one of the most important coverage options, but some condo owners believe they don't need it because they are not at risk of causing harm to others or damaging property.

You need to understand that some events will be out of control and it is important to be prepared ahead of time so that you protect yourself from further issues.

Myth #4 - Renovations are automatically covered

Home improvements and renovations can add significant value to your condo, but assuming they are automatically covered by your insurance policy might be a costly misconception for which you will have to pay out of your pocket in the future.

Well, what do you think now? Myths are everywhere! And you get to decide what to believe. We want you to have enough information and clarity so that you can choose the right condo insurance coverage.

With that, let’s see what condo (HO-6) insurance covers in the next section.

What is included in the best condo insurance?

Selecting the best homeowners insurance for condos is going to be an important step in protecting your investment and securing peace of mind.

So, come let’s understand the elements that go into your insurance!

-

It protects the physical structure of your unit during events like fire, vandalism, or natural disasters.

-

You have the right policy if your personal property is covered and your furniture, electronics, clothing, and other possessions are safe and secured.

-

Your coverage protects you and others against injuries for which you are held responsible.

-

It covers all your additional living expense costs and ensures you are safe until your condo property is completely restored.

To wrap up, the best way to select the right condo insurance is to check if all the above elements are covered in your policy. If yes, go ahead and get your HO-6 insurance papers signed.

What are the next steps?

We would like to thank and congratulate you for taking the first steps towards protecting your new condo living space.

Always keep in mind that your condo is more than just a space! Take the time to assess your unique needs and the value of your belongings.

Consider any specific risks associated with your location and the features of your condo. Understanding these factors will help you in customizing your policy effectively.

Know what goes into your dwelling, personal liability, personal property, and additional living expense coverage to ensure you receive the right condo insurance policy.

Lastly, don’t just look for affordability. Explore offerings from multiple insurance providers to have a balanced coverage.

The right policy is just a click away.

Did you find this article helpful? Share it!