5 Practical Tips for Filing an Auto Insurance Medical Payments Claim

About 73% of Americans get to work by car and 92% of them own one. Only 13% of Americans use public transportation to commute to their jobs.

Whether you take out your car to work, buy groceries, or just drive for leisure, it is good to consider getting car insurance medical payments coverage.

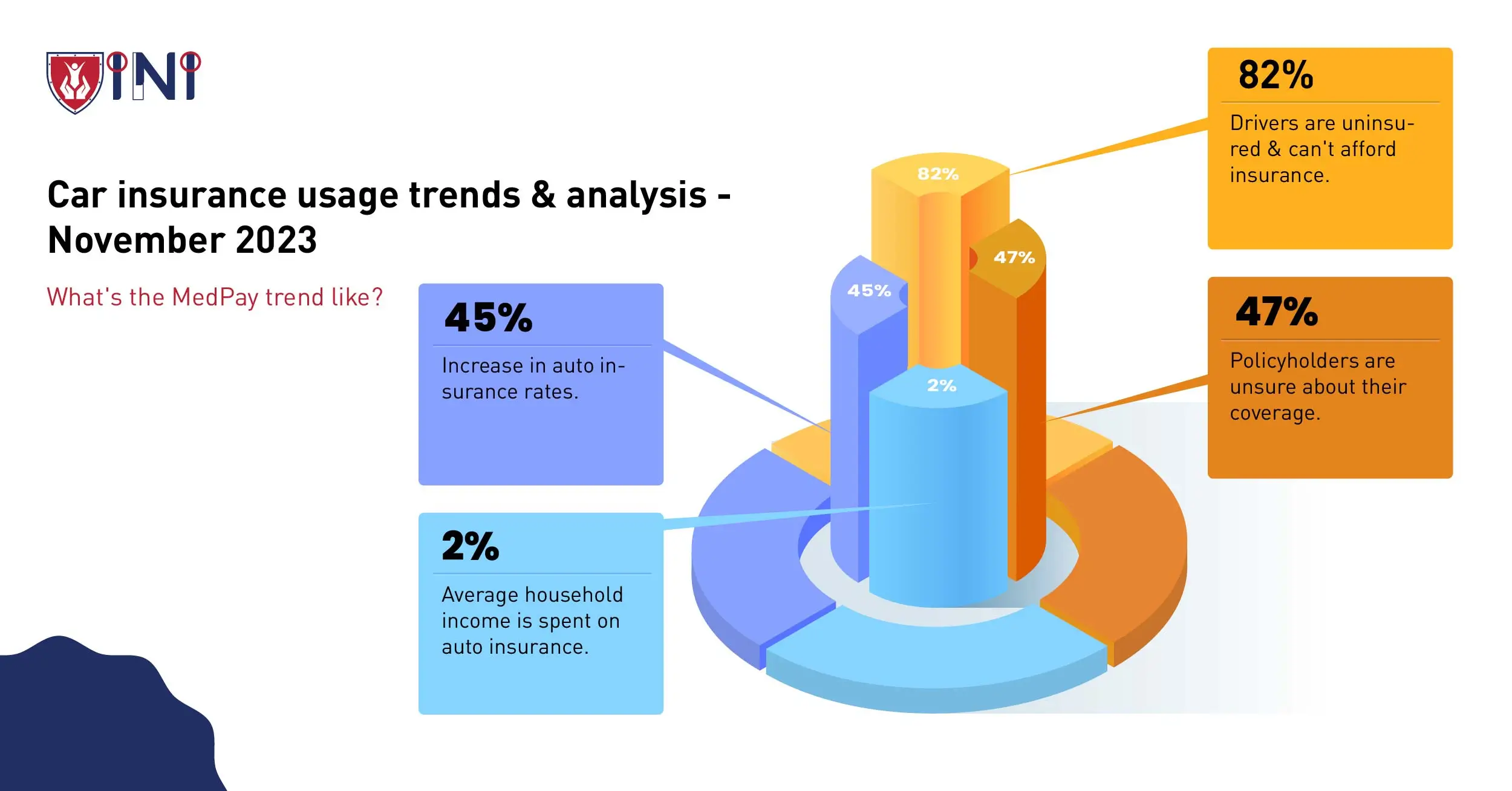

Today in this blog, we will understand the need for automobile medical payments coverage and highlight its differences from full auto insurance coverage.

What is auto insurance medical payments coverage?

It is an optional car insurance coverage often referred to as MedPay, which helps pay for all the medical expenses resulting from car accidents.

-

MedPay helps cover the expenses for you and passengers involved in an accident. Additionally, it also covers expenses for accidents that happen when you’re traveling with another driver.

-

If you own a car and are an urban hustler, getting automobile medical payments coverage could be the best option as MedPay covers medical costs for you, your passengers, and pedestrians, regardless of who is at fault.

-

Medical payments coverage can be used for a variety of medical expenses, including hospital bills, surgery, X-rays, dental care, and even funeral expenses in the event of a fatal accident.

-

As medical expenses continue to rise, having sufficient medical payments coverage is more critical than ever.

Benefits of MedPay coverage

Exploring the possibilities of MedPay insurance ensures quick financial assistance during uncertain times of accidents. It’s time to find out how auto insurance medical payment coverage goes beyond the full coverage policy.

-

Full protection regardless of fault

-

One of the primary benefits of MedPay is its no-fault nature. It covers medical expenses for you and your passengers, regardless of who caused the accident, providing a layer of protection that goes beyond traditional liability coverage.

-

-

Coverage for all

-

Car insurance medical payments coverage extends its benefits to not only the policyholder but also passengers in the insured vehicle along with the pedestrians involved in an accident with the insured vehicle.

-

Therefore, MedPay coverage ensures comprehensive protection for all parties affected by the accident.

-

-

Easy access to funds

-

Med pay auto insurance is designed to provide quick access to funds for medical expenses. The car insurance medical payments coverage realizes the importance of financial assistance in the timely treatment of injuries caused by an accident.

-

Full car insurance coverage vs MedPay coverage

There is no such term as full auto coverage insurance, but the actual meaning behind it is that the policy combines liability, comprehensive, and collision coverage as a whole.

Car insurance medical payments coverage can save you from huge medical expenses after an accident but, it is up to you to decide if you can handle extra premium payment. To help you decide we have distinguished the two types of auto insurance below;

| Full auto insurance coverage | MedPay coverage |

|---|---|

| 1) This coverage combines various types of coverage within the policy, including liability, collision, and comprehensive. | 1) The main focus of MedPay is to cover medical expenses resulting from an auto accident. |

| 2) It offers a well-rounded and all-encompassing protection plan, addressing not only medical expenses but also damages to the insured vehicle, liability concerns, theft, and other potential risks. | 2) Med pay auto insurance claims to operate on a no-fault basis, providing coverage regardless of who caused the accident. |

| 3) Policyholders who opt for auto insurance full coverage have the flexibility to tailor their insurance to specific needs, choosing coverage types that align with their individual circumstances. | 3) They are designed for quick access to funds, facilitating the swift settlement of medical bills and treatment expenses. |

| 4) Mostly required during a sale or lease or when someone buys a car via a loan. | 4) Offers coverage beyond the policyholder, encompassing passengers and pedestrians, providing safety for various individuals affected by the accident. |

| 5) Goes beyond immediate medical needs to address a wide range of potential risks associated with driving and vehicle ownership. | 5) MedPay addresses the immediate medical needs of the policyholder, passengers, and pedestrians involved in the accident. |

How to choose the right MedPay coverage?

If you’re someone who feels that you require enough protection and can afford a higher premium payment, you can go ahead and get the auto insurance med pay coverage.

However, it is important to choose the right auto MedPay coverage. From assessing your personal medical needs to understanding coverage limits and comparing offerings from different insurance providers, follow these strategies below to cut costs.

-

Review your existing health insurance policy and understand the extent of its coverage to identify any gaps that MedPay can fill.

-

If you do have health insurance coverage, automobile medical payments coverage can help you cover certain out-of-pocket costs.

-

Evaluate your overall driving practices and the frequency of car travel along with the accident rate in your county. Higher risk factors result in higher MedPay coverage.

-

MedPay is not available in every state and depending on the state and the insurer, the car insurance medical payments coverage varies ranging from $1,000 to $25,000 per person.

-

Understand that coverage limits determine the maximum amount your policy will pay for medical expenses per person or per accident.

-

While it can be tempting to choose from the wide range of MedPay coverages available, it is advisable to go for the most affordable and adequate coverage you need as with the rise in inflation, premiums might increase.

-

Research, explore, and compare offerings from different insurance providers. Go for an insurance provider who can get you the best premium rates while offering comprehensive options.

-

Look for reviews from other policyholders and consider their thoughts on the coverage offered. Learn how every insurer handles claims.

-

If you’re planning to go for the same insurer then consider bundling your auto insurance med pay with other insurance policies so that you can tap into potential discounts or premium benefits.

-

Getting personalized guidance from a mortgage specialist can help you get valuable insights on the right coverage that is required based on individual circumstances.

Explore the range of options available in our car insurance quote and find the plan that fits your ride. Indemnity National Insurance prioritizes affordability and comprehensive coverage in every situation to keep you safe and secure while driving.

A step-by-step guide to filing the MedPay claim

Experiencing an accident can be overwhelming and it worries the families of individuals who are injured. During these stressful times, the process of filing a claim should not be an added burden.

So, as we promised here is the step-by-step guide to filing an auto insurance medical payments claim.

Step 1: Look for immediate medical attention & safety

It is important to prioritize your well-being and the well-being of others involved in the accident. Giving immediate medical assistance can have an impact on the overall recovery process.

Step 2: Document essential information at the scene

Collecting relevant information at the place of the accident if you’re in a safe position without any injuries. This information can add adequate importance to your insurance claim. Make sure to obtain information such as

-

Name, contact, and insurance information of all the parties involved in the accident.

-

Location, time, and date of accident.

-

Names and contacts of witnesses if present.

-

If law enforcement responds to the scene, obtain a copy of the police report.

Step 3: Gather medical information

Thorough documentation of medical expenses and treatments is crucial for a successful auto insurance medical payments claim. While you track and record all the medical expenses, make sure to keep this in mind:

-

Medical bills related to accidents, including hospital stays, surgeries, medications, and rehabilitation.

-

Maintain records of prescribed medicines and costs associated with buying these.

-

Include all the treatment plans prescribed for recovery. It could be therapy sessions or ongoing medical care.

-

If possible, click photographs of injuries along with the car object that caused these injuries to provide visual documentation.

Step 4: Get in touch with the insurer

Communicate and provide all the above documentation to the insurer verbally, in writing, and visually as soon as possible. Provide them with detailed information about the accident and injuries.

To strengthen your claim process, make sure to attach all the supporting documents such as medical bills, treatment receipts, and any other information requested by the form.

Step 5: Submit the claim form, review and receive the payout

Fill out the form with relevant details and submit the completed MedPay claim form along with all the supporting documents to your insurance provider. Confirm the preferred submission method and retain all the submitted documents for your needs.

Once your claim is submitted, a claims adjuster will be assigned to assess your case. Upon the completion of this assessment, you will receive a settlement offer from your insurance provider.

Take time to review the offer and negotiate to reach a fair settlement. Once it has been agreed upon, your insurance provider will release the auto insurance medical payments.

Key points for discussion

Filing an insurance claim for your vehicle might seem like a challenging task but with clear and transparent communication, it is easier to make the process as efficient and smooth as possible.

It is essential to assess and update your car insurance policies to emphasize a proactive approach to getting the maximum coverage.

Whether you choose full auto insurance coverage or MedPay coverage, consider your driving habits and your ability to handle higher premium payments in the long run.

Get a no-obligation MedPay quote now

Did you find this article helpful? Share it!